@backtest-kit/sidekick 0.1.2 → 3.0.1

This diff represents the content of publicly available package versions that have been released to one of the supported registries. The information contained in this diff is provided for informational purposes only and reflects changes between package versions as they appear in their respective public registries.

- package/README.md +120 -13

- package/content/config/source/timeframe_15m.pine +114 -0

- package/content/config/source/timeframe_4h.pine +57 -0

- package/content/config/symbol.config.cjs +460 -0

- package/content/docker/ollama/docker-compose.yaml +34 -0

- package/content/docker/ollama/watch.sh +2 -0

- package/content/scripts/cache/cache_candles.mjs +47 -0

- package/content/scripts/cache/cache_model.mjs +42 -0

- package/content/scripts/cache/validate_candles.mjs +46 -0

- package/content/scripts/run_timeframe_15m.mjs +77 -0

- package/content/scripts/run_timeframe_4h.mjs +68 -0

- package/package.json +2 -2

- package/scripts/init.mjs +40 -9

- package/src/classes/BacktestLowerStopOnBreakevenAction.mjs +18 -0

- package/src/classes/BacktestPartialProfitTakingAction.mjs +5 -0

- package/src/classes/BacktestPositionMonitorAction.mjs +4 -0

- package/src/config/setup.mjs +27 -1

- package/src/enum/ActionName.mjs +1 -1

- package/src/enum/FrameName.mjs +1 -0

- package/src/enum/RiskName.mjs +1 -1

- package/src/logic/action/backtest_lower_stop_on_breakeven.action.mjs +9 -0

- package/src/logic/exchange/binance.exchange.mjs +12 -2

- package/src/logic/frame/feb_2024.frame.mjs +10 -0

- package/src/logic/index.mjs +3 -2

- package/src/logic/risk/sl_distance.risk.mjs +32 -0

- package/src/logic/risk/tp_distance.risk.mjs +5 -3

- package/src/logic/strategy/main.strategy.mjs +29 -12

- package/src/main/bootstrap.mjs +1 -1

- package/src/math/timeframe_15m.math.mjs +68 -0

- package/src/math/timeframe_4h.math.mjs +53 -0

- package/template/CLAUDE.mustache +421 -0

- package/template/README.mustache +232 -24

- package/template/env.mustache +1 -17

- package/template/jsconfig.json.mustache +1 -0

- package/template/package.mustache +5 -4

- package/src/classes/BacktestTightenStopOnBreakevenAction.mjs +0 -13

- package/src/func/market.func.mjs +0 -46

- package/src/logic/action/backtest_tighten_stop_on_breakeven.action.mjs +0 -9

- package/src/logic/risk/rr_ratio.risk.mjs +0 -39

- /package/{types/backtest-kit.d.ts → template/types.mustache} +0 -0

package/README.md

CHANGED

|

@@ -1,25 +1,26 @@

|

|

|

1

1

|

# 🧿 @backtest-kit/sidekick

|

|

2

2

|

|

|

3

|

-

> The easiest way to create a new Backtest Kit trading bot project.

|

|

3

|

+

> The easiest way to create a new Backtest Kit trading bot project. Scaffolds a multi-timeframe crypto trading strategy with Pine Script indicators via [PineTS](https://github.com/QuantForgeOrg/PineTS) runtime, 4H trend filter + 15m signal generator, partial profit taking, breakeven trailing stops, and risk validation.

|

|

4

4

|

|

|

5

|

-

|

|

6

6

|

|

|

7

7

|

[](https://deepwiki.com/tripolskypetr/backtest-kit)

|

|

8

8

|

[](https://npmjs.org/package/@backtest-kit/sidekick)

|

|

9

9

|

[](https://github.com/tripolskypetr/backtest-kit/blob/master/LICENSE)

|

|

10

10

|

|

|

11

|

-

Create production-ready trading bots in seconds with pre-configured templates, LLM integration, and technical analysis.

|

|

12

|

-

|

|

13

11

|

📚 **[Backtest Kit Docs](https://backtest-kit.github.io/documents/example_02_first_backtest.html)** | 🌟 **[GitHub](https://github.com/tripolskypetr/backtest-kit)**

|

|

14

12

|

|

|

15

13

|

## ✨ Features

|

|

16

14

|

|

|

17

15

|

- 🚀 **Zero Config**: Get started with one command - no setup required

|

|

18

|

-

-

|

|

19

|

-

-

|

|

20

|

-

-

|

|

21

|

-

-

|

|

22

|

-

-

|

|

16

|

+

- 📊 **Multi-timeframe analysis** — 4H daily trend filter (RSI + MACD + ADX) combined with 15m entry signals (EMA crossover + volume spike + momentum)

|

|

17

|

+

- 📜 **Pine Script indicators** — strategies written in TradingView Pine Script v5, executed locally via `@backtest-kit/pinets`

|

|

18

|

+

- 🛡️ **Risk management** — SL/TP distance validation, Kelly-optimized partial profit taking (33/33/34%), breakeven trailing stop

|

|

19

|

+

- 🔄 **Position lifecycle** — full monitoring with scheduled/opened/closed/cancelled event logging

|

|

20

|

+

- 🔌 **Binance integration** — OHLCV candles, order book depth, tick-precise price/quantity formatting via CCXT

|

|

21

|

+

- 🕐 **Historical frames** — predefined backtest periods covering bull runs, sharp drops, and sideways markets

|

|

22

|

+

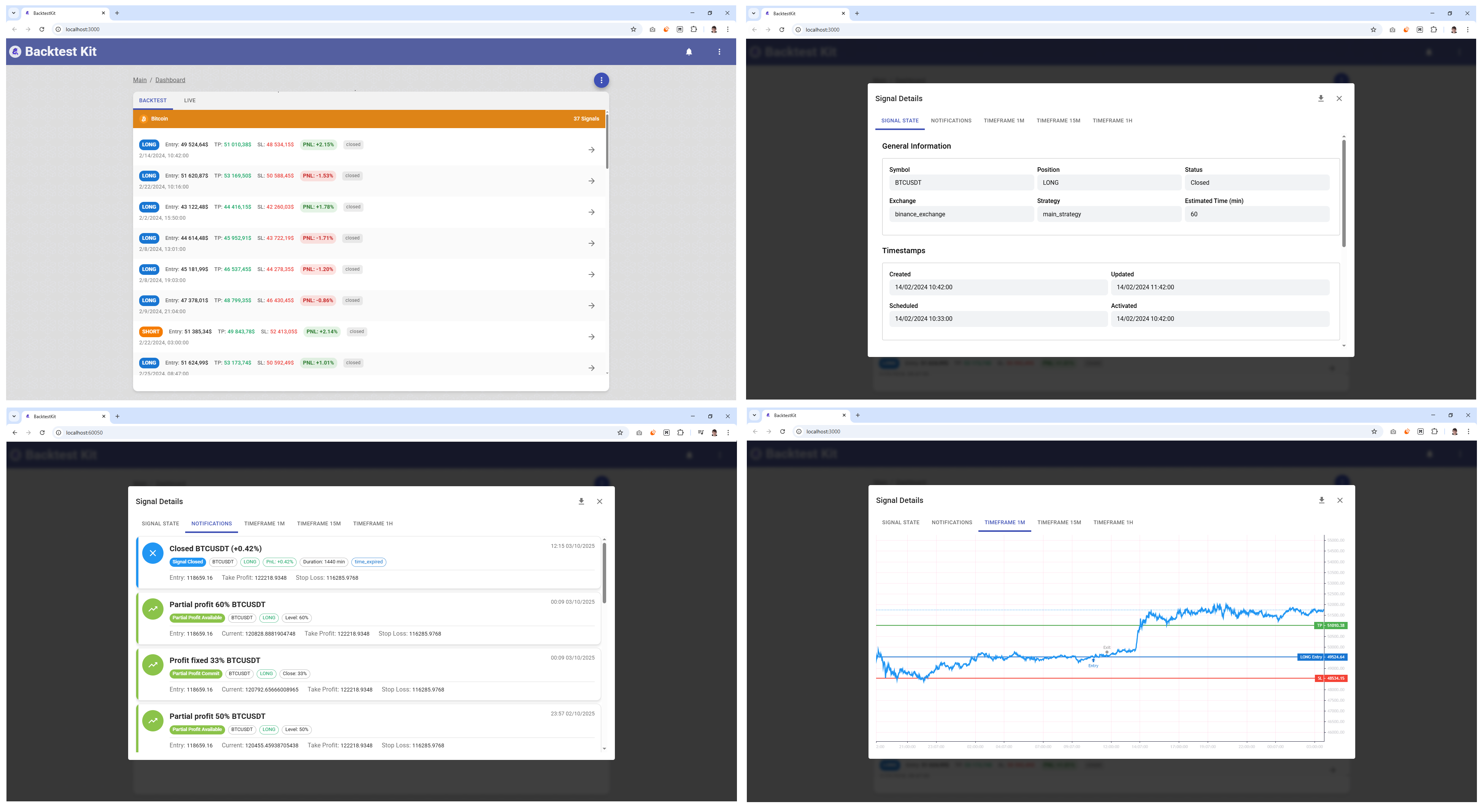

- 🎨 **Web UI dashboard** — interactive charting via `@backtest-kit/ui`

|

|

23

|

+

- 💾 **Persistent storage** — crash-safe state with atomic persistence for both backtest and live modes

|

|

23

24

|

|

|

24

25

|

## 🚀 Quick Start

|

|

25

26

|

|

|

@@ -32,12 +33,104 @@ npm start

|

|

|

32

33

|

```

|

|

33

34

|

|

|

34

35

|

That's it! You now have a working trading bot with:

|

|

35

|

-

-

|

|

36

|

-

-

|

|

37

|

-

-

|

|

38

|

-

-

|

|

36

|

+

- Multi-timeframe Pine Script strategy (4H trend + 15m signals)

|

|

37

|

+

- Risk management validation (SL/TP distance checks)

|

|

38

|

+

- Partial profit taking and breakeven trailing stops

|

|

39

|

+

- Cache utilities and debug scripts

|

|

40

|

+

- CLAUDE.md for AI-assisted strategy iteration

|

|

39

41

|

- Environment configuration

|

|

40

42

|

|

|

43

|

+

## 🏗️ Generated Project Structure

|

|

44

|

+

|

|

45

|

+

```

|

|

46

|

+

my-trading-bot/

|

|

47

|

+

├── src/

|

|

48

|

+

│ ├── index.mjs # Entry point — loads config, logic, bootstrap

|

|

49

|

+

│ ├── main/bootstrap.mjs # Mode dispatcher (backtest / paper / live)

|

|

50

|

+

│ ├── config/

|

|

51

|

+

│ │ ├── setup.mjs # Logger, storage, notifications, UI server

|

|

52

|

+

│ │ ├── validate.mjs # Schema validation for all enums

|

|

53

|

+

│ │ ├── params.mjs # Environment variables (Ollama API key)

|

|

54

|

+

│ │ └── ccxt.mjs # Binance exchange singleton via CCXT

|

|

55

|

+

│ ├── logic/

|

|

56

|

+

│ │ ├── strategy/main.strategy.mjs # Main strategy — multi-TF signal logic

|

|

57

|

+

│ │ ├── exchange/binance.exchange.mjs # Exchange schema — candles, order book, formatting

|

|

58

|

+

│ │ ├── frame/*.frame.mjs # Backtest time frames (Feb 2024, Oct–Dec 2025)

|

|

59

|

+

│ │ ├── risk/sl_distance.risk.mjs # Stop-loss distance validation (≥0.2%)

|

|

60

|

+

│ │ ├── risk/tp_distance.risk.mjs # Take-profit distance validation (≥0.2%)

|

|

61

|

+

│ │ └── action/

|

|

62

|

+

│ │ ├── backtest_partial_profit_taking.action.mjs

|

|

63

|

+

│ │ ├── backtest_lower_stop_on_breakeven.action.mjs

|

|

64

|

+

│ │ └── backtest_position_monitor.action.mjs

|

|

65

|

+

│ ├── classes/

|

|

66

|

+

│ │ ├── BacktestPartialProfitTakingAction.mjs # Scale out at 3 TP levels

|

|

67

|

+

│ │ ├── BacktestLowerStopOnBreakevenAction.mjs # Trailing stop on breakeven

|

|

68

|

+

│ │ └── BacktestPositionMonitorAction.mjs # Position event logger

|

|

69

|

+

│ ├── math/

|

|

70

|

+

│ │ ├── timeframe_4h.math.mjs # 4H trend data — RSI, MACD, ADX, DI+/DI-

|

|

71

|

+

│ │ └── timeframe_15m.math.mjs # 15m signal data — EMA, ATR, volume, momentum

|

|

72

|

+

│ ├── enum/ # String constants for type-safe schema refs

|

|

73

|

+

│ └── utils/getArgs.mjs # CLI argument parser with defaults

|

|

74

|

+

├── config/source/

|

|

75

|

+

│ ├── timeframe_4h.pine # Pine Script v5 — Daily Trend Filter (RSI/MACD/ADX)

|

|

76

|

+

│ └── timeframe_15m.pine # Pine Script v5 — Signal Strategy (EMA/ATR/Volume)

|

|

77

|

+

├── scripts/

|

|

78

|

+

│ ├── run_timeframe_15m.mjs # Standalone 15m Pine Script runner

|

|

79

|

+

│ ├── run_timeframe_4h.mjs # Standalone 4H Pine Script runner

|

|

80

|

+

│ └── cache/

|

|

81

|

+

│ ├── cache_candles.mjs # Pre-download OHLCV candles (1m/15m/4h)

|

|

82

|

+

│ ├── validate_candles.mjs # Verify cached candle data integrity

|

|

83

|

+

│ └── cache_model.mjs # Pull Ollama LLM model with progress bar

|

|

84

|

+

├── docker/ollama/

|

|

85

|

+

│ ├── docker-compose.yaml # Ollama GPU container setup

|

|

86

|

+

│ └── watch.sh # nvidia-smi monitor

|

|

87

|

+

├── CLAUDE.md # AI strategy development guide

|

|

88

|

+

├── .env # Environment variables

|

|

89

|

+

└── package.json # Dependencies

|

|

90

|

+

```

|

|

91

|

+

|

|

92

|

+

## 💡 Strategy Overview

|

|

93

|

+

|

|

94

|

+

### 🎯 4H Trend Filter (`timeframe_4h.pine`)

|

|

95

|

+

|

|

96

|

+

Determines the market regime using three indicators:

|

|

97

|

+

|

|

98

|

+

| Regime | Condition |

|

|

99

|

+

|--------|-----------|

|

|

100

|

+

| **AllowLong** | ADX > 25, MACD histogram > 0, DI+ > DI-, RSI > 50 |

|

|

101

|

+

| **AllowShort** | ADX > 25, MACD histogram < 0, DI- > DI+, RSI < 50 |

|

|

102

|

+

| **AllowBoth** | Strong trend but no clear bull/bear regime |

|

|

103

|

+

| **NoTrades** | ADX ≤ 25 (weak trend) |

|

|

104

|

+

|

|

105

|

+

### ⚡ 15m Signal Generator (`timeframe_15m.pine`)

|

|

106

|

+

|

|

107

|

+

Generates entry signals with EMA crossover confirmed by volume and momentum:

|

|

108

|

+

|

|

109

|

+

- **Long**: EMA(5) crosses above EMA(13), RSI 40–65, price above EMA(50), volume spike (>1.5x MA), positive momentum

|

|

110

|

+

- **Short**: EMA(5) crosses below EMA(13), RSI 35–60, price below EMA(50), volume spike, negative momentum

|

|

111

|

+

- **SL/TP**: Static 2%/3% from entry price

|

|

112

|

+

- **Signal expiry**: 5 bars

|

|

113

|

+

|

|

114

|

+

### 🛡️ Risk Filters

|

|

115

|

+

|

|

116

|

+

- Reject signals where SL distance < 0.2% (slippage protection)

|

|

117

|

+

- Reject signals where TP distance < 0.2% (slippage protection)

|

|

118

|

+

- Trend alignment: long signals rejected in bear regime, short signals rejected in bull regime

|

|

119

|

+

|

|

120

|

+

### 💹 Position Management

|

|

121

|

+

|

|

122

|

+

- **Partial profit taking**: Scale out at 3 levels — 33% at TP3, 33% at TP2, 34% at TP1

|

|

123

|

+

- **Breakeven trailing stop**: When breakeven is reached, lower trailing stop by 3 points

|

|

124

|

+

|

|

125

|

+

## 🕐 Backtest Frames

|

|

126

|

+

|

|

127

|

+

| Frame | Period | Market Note |

|

|

128

|

+

|-------|--------|-------------|

|

|

129

|

+

| `February2024` | Feb 1–29, 2024 | Bull run |

|

|

130

|

+

| `October2025` | Oct 1–31, 2025 | Sharp drop Oct 9–11 |

|

|

131

|

+

| `November2025` | Nov 1–30, 2025 | Sideways with downtrend |

|

|

132

|

+

| `December2025` | Dec 1–31, 2025 | Sideways, no clear direction |

|

|

133

|

+

|

|

41

134

|

## 💡 CLI Options

|

|

42

135

|

|

|

43

136

|

```bash

|

|

@@ -48,6 +141,20 @@ npx -y @backtest-kit/sidekick my-bot

|

|

|

48

141

|

npx -y @backtest-kit/sidekick .

|

|

49

142

|

```

|

|

50

143

|

|

|

144

|

+

## 📋 Dependencies

|

|

145

|

+

|

|

146

|

+

| Package | Purpose |

|

|

147

|

+

|---------|---------|

|

|

148

|

+

| [backtest-kit](https://libraries.io/npm/backtest-kit) | Core backtesting/trading framework |

|

|

149

|

+

| [@backtest-kit/pinets](https://github.com/QuantForgeOrg/PineTS) | Pine Script v5 runtime for Node.js |

|

|

150

|

+

| [@backtest-kit/ui](https://libraries.io/npm/backtest-kit) | Interactive charting dashboard |

|

|

151

|

+

| [@backtest-kit/ollama](https://libraries.io/npm/backtest-kit) | LLM inference integration |

|

|

152

|

+

| [ccxt](https://github.com/ccxt/ccxt) | Binance exchange connectivity |

|

|

153

|

+

| [functools-kit](https://www.npmjs.com/package/functools-kit) | `singleshot`, `randomString` utilities |

|

|

154

|

+

| [pinolog](https://www.npmjs.com/package/pinolog) | File-based structured logging |

|

|

155

|

+

| [openai](https://www.npmjs.com/package/openai) | OpenAI API client |

|

|

156

|

+

| [ollama](https://www.npmjs.com/package/ollama) | Ollama local LLM client |

|

|

157

|

+

|

|

51

158

|

## 🔗 Links

|

|

52

159

|

|

|

53

160

|

- [Backtest Kit Documentation](https://backtest-kit.github.io/documents/example_02_first_backtest.html)

|

|

@@ -0,0 +1,114 @@

|

|

|

1

|

+

//@version=5

|

|

2

|

+

indicator("Signal Strategy 15m v1", overlay=true)

|

|

3

|

+

|

|

4

|

+

plotcandle(open, high, low, close,

|

|

5

|

+

color=close > open ? color.new(color.green, 70) : color.new(color.red, 70),

|

|

6

|

+

wickcolor=color.new(color.gray, 70),

|

|

7

|

+

bordercolor=color.new(color.gray, 70))

|

|

8

|

+

|

|

9

|

+

|

|

10

|

+

// === INPUTS ===

|

|

11

|

+

rsi_len = input.int(7, "RSI Length", minval=2)

|

|

12

|

+

ema_fast_len = input.int(5, "EMA Fast", minval=1)

|

|

13

|

+

ema_slow_len = input.int(13, "EMA Slow", minval=1)

|

|

14

|

+

ema_trend_len = input.int(50, "EMA Trend", minval=1)

|

|

15

|

+

atr_len = input.int(14, "ATR Length", minval=1)

|

|

16

|

+

vol_ma_len = input.int(20, "Volume MA Length", minval=1)

|

|

17

|

+

|

|

18

|

+

sl_mult = input.float(1.5, "SL ATR Multiplier", minval=0.5, step=0.1)

|

|

19

|

+

tp_mult = input.float(2.5, "TP ATR Multiplier", minval=0.5, step=0.1)

|

|

20

|

+

signal_valid_bars = input.int(5, "Signal Valid Bars", minval=1)

|

|

21

|

+

|

|

22

|

+

// === INDICATORS ===

|

|

23

|

+

rsi = ta.rsi(close, rsi_len)

|

|

24

|

+

ema_fast = ta.ema(close, ema_fast_len)

|

|

25

|

+

ema_slow = ta.ema(close, ema_slow_len)

|

|

26

|

+

ema_trend = ta.ema(close, ema_trend_len)

|

|

27

|

+

atr = ta.atr(atr_len)

|

|

28

|

+

|

|

29

|

+

// Volume filter - выше среднего

|

|

30

|

+

vol_ma = ta.sma(volume, vol_ma_len)

|

|

31

|

+

vol_spike = volume > vol_ma * 1.5

|

|

32

|

+

|

|

33

|

+

// Momentum confirmation

|

|

34

|

+

mom = ta.mom(close, 3)

|

|

35

|

+

mom_up = mom > 0

|

|

36

|

+

mom_down = mom < 0

|

|

37

|

+

|

|

38

|

+

// === TREND FILTER ===

|

|

39

|

+

trend_up = close > ema_trend and ema_fast > ema_trend

|

|

40

|

+

trend_down = close < ema_trend and ema_fast < ema_trend

|

|

41

|

+

|

|

42

|

+

// === ENTRY CONDITIONS ===

|

|

43

|

+

// Long: пересечение + RSI не перекуплен + тренд вверх + объём + momentum

|

|

44

|

+

long_cond = ta.crossover(ema_fast, ema_slow) and rsi > 40 and rsi < 65 and trend_up and vol_spike and mom_up

|

|

45

|

+

|

|

46

|

+

// Short: пересечение + RSI не перепродан + тренд вниз + объём + momentum

|

|

47

|

+

short_cond = ta.crossunder(ema_fast, ema_slow) and rsi < 60 and rsi > 35 and trend_down and vol_spike and mom_down

|

|

48

|

+

|

|

49

|

+

// === SIGNAL MANAGEMENT ===

|

|

50

|

+

var int bars_since_signal = 0

|

|

51

|

+

var int last_signal = 0

|

|

52

|

+

var float entry_price = na

|

|

53

|

+

var float signal_atr = na

|

|

54

|

+

|

|

55

|

+

if long_cond

|

|

56

|

+

last_signal := 1

|

|

57

|

+

bars_since_signal := 0

|

|

58

|

+

entry_price := close

|

|

59

|

+

signal_atr := atr

|

|

60

|

+

else if short_cond

|

|

61

|

+

last_signal := -1

|

|

62

|

+

bars_since_signal := 0

|

|

63

|

+

entry_price := close

|

|

64

|

+

signal_atr := atr

|

|

65

|

+

else

|

|

66

|

+

bars_since_signal += 1

|

|

67

|

+

|

|

68

|

+

// Signal expires faster on 15m

|

|

69

|

+

active_signal = bars_since_signal <= signal_valid_bars ? last_signal : 0

|

|

70

|

+

|

|

71

|

+

// === DYNAMIC SL/TP based on ATR ===

|

|

72

|

+

// sl = last_signal == 1 ? entry_price - signal_atr * sl_mult : last_signal == -1 ? entry_price + signal_atr * sl_mult : na

|

|

73

|

+

// tp = last_signal == 1 ? entry_price + signal_atr * tp_mult : last_signal == -1 ? entry_price - signal_atr * tp_mult : na

|

|

74

|

+

|

|

75

|

+

// === STATIC SL/TP for watch strategy ==

|

|

76

|

+

sl = last_signal == -1 ? close * 1.02 : close * 0.98

|

|

77

|

+

tp = last_signal == -1 ? close * 0.97 : close * 1.03

|

|

78

|

+

|

|

79

|

+

// === VISUALIZATION ===

|

|

80

|

+

line_color = active_signal == 1 ? color.green : active_signal == -1 ? color.red : color.gray

|

|

81

|

+

|

|

82

|

+

plot(ema_fast, "EMA Fast", color=color.new(color.blue, 50), linewidth=1)

|

|

83

|

+

plot(ema_slow, "EMA Slow", color=color.new(color.orange, 50), linewidth=1)

|

|

84

|

+

plot(ema_trend, "EMA Trend", color=color.new(color.white, 70), linewidth=2)

|

|

85

|

+

|

|

86

|

+

plotshape(long_cond, "Long", shape.triangleup, location.belowbar, color.green, size=size.small)

|

|

87

|

+

plotshape(short_cond, "Short", shape.triangledown, location.abovebar, color.red, size=size.small)

|

|

88

|

+

|

|

89

|

+

plot(close, "Active Signal", color=line_color, linewidth=6)

|

|

90

|

+

|

|

91

|

+

// === OUTPUTS FOR BOT ===

|

|

92

|

+

plot(close, "Close", display=display.data_window)

|

|

93

|

+

plot(active_signal, "Signal", display=display.data_window)

|

|

94

|

+

plot(sl, "StopLoss", display=display.data_window)

|

|

95

|

+

plot(tp, "TakeProfit", display=display.data_window)

|

|

96

|

+

plot(1440, "EstimatedTime", display=display.data_window) // 24 hour for 15m TF

|

|

97

|

+

|

|

98

|

+

// === DEBUG: INDICATOR DUMP ===

|

|

99

|

+

plot(rsi, "d_RSI", display=display.data_window)

|

|

100

|

+

plot(ema_fast, "d_EmaFast", display=display.data_window)

|

|

101

|

+

plot(ema_slow, "d_EmaSlow", display=display.data_window)

|

|

102

|

+

plot(ema_trend, "d_EmaTrend", display=display.data_window)

|

|

103

|

+

plot(atr, "d_ATR", display=display.data_window)

|

|

104

|

+

plot(volume, "d_Volume", display=display.data_window)

|

|

105

|

+

plot(vol_ma, "d_VolMA", display=display.data_window)

|

|

106

|

+

plot(vol_spike ? 1 : 0, "d_VolSpike", display=display.data_window)

|

|

107

|

+

plot(mom, "d_Mom", display=display.data_window)

|

|

108

|

+

plot(mom_up ? 1 : 0, "d_MomUp", display=display.data_window)

|

|

109

|

+

plot(mom_down ? 1 : 0, "d_MomDown", display=display.data_window)

|

|

110

|

+

plot(trend_up ? 1 : 0, "d_TrendUp", display=display.data_window)

|

|

111

|

+

plot(trend_down ? 1 : 0, "d_TrendDown", display=display.data_window)

|

|

112

|

+

plot(long_cond ? 1 : 0, "d_LongCond", display=display.data_window)

|

|

113

|

+

plot(short_cond ? 1 : 0, "d_ShortCond", display=display.data_window)

|

|

114

|

+

plot(bars_since_signal, "d_BarsSinceSignal", display=display.data_window)

|

|

@@ -0,0 +1,57 @@

|

|

|

1

|

+

//@version=5

|

|

2

|

+

indicator("Daily Trend Filter", overlay=true)

|

|

3

|

+

|

|

4

|

+

plotcandle(open, high, low, close,

|

|

5

|

+

color=close > open ? color.new(color.green, 70) : color.new(color.red, 70),

|

|

6

|

+

wickcolor=color.new(color.gray, 70),

|

|

7

|

+

bordercolor=color.new(color.gray, 70))

|

|

8

|

+

|

|

9

|

+

// === INPUTS ===

|

|

10

|

+

rsi_len = input.int(14, "RSI Length", minval=2)

|

|

11

|

+

macd_fast = input.int(12, "MACD Fast", minval=1)

|

|

12

|

+

macd_slow = input.int(26, "MACD Slow", minval=1)

|

|

13

|

+

macd_signal = input.int(9, "MACD Signal", minval=1)

|

|

14

|

+

adx_len = input.int(14, "ADX Length", minval=1)

|

|

15

|

+

adx_threshold = input.int(25, "ADX Threshold", minval=10)

|

|

16

|

+

|

|

17

|

+

rsi_bull_threshold = input.int(50, "RSI Bull Threshold", minval=50, maxval=70)

|

|

18

|

+

rsi_bear_threshold = input.int(50, "RSI Bear Threshold", minval=30, maxval=50)

|

|

19

|

+

|

|

20

|

+

// === INDICATORS ===

|

|

21

|

+

rsi = ta.rsi(close, rsi_len)

|

|

22

|

+

[macd_line, signal_line, macd_hist] = ta.macd(close, macd_fast, macd_slow, macd_signal)

|

|

23

|

+

[di_plus, di_minus, adx] = ta.dmi(adx_len, adx_len)

|

|

24

|

+

|

|

25

|

+

// === TREND FILTER LOGIC ===

|

|

26

|

+

strong_trend = adx > adx_threshold

|

|

27

|

+

|

|

28

|

+

bull_regime = strong_trend and macd_hist > 0 and di_plus > di_minus and rsi > rsi_bull_threshold

|

|

29

|

+

|

|

30

|

+

bear_regime = strong_trend and macd_hist < 0 and di_minus > di_plus and rsi < rsi_bear_threshold

|

|

31

|

+

|

|

32

|

+

both_allowed = strong_trend and not bull_regime and not bear_regime

|

|

33

|

+

no_trades = not strong_trend

|

|

34

|

+

|

|

35

|

+

// === VISUALIZATION ===

|

|

36

|

+

line_color = bull_regime ? color.green :

|

|

37

|

+

bear_regime ? color.red :

|

|

38

|

+

both_allowed ? color.gray :

|

|

39

|

+

color.orange

|

|

40

|

+

|

|

41

|

+

plot(close, "Active Signal", color=line_color, linewidth=6)

|

|

42

|

+

|

|

43

|

+

// === OUTPUTS FOR BOT ===

|

|

44

|

+

plot(bull_regime ? 1 : 0, "AllowLong", display=display.data_window)

|

|

45

|

+

plot(bear_regime ? 1 : 0, "AllowShort", display=display.data_window)

|

|

46

|

+

plot(both_allowed ? 1 : 0, "AllowBoth", display=display.data_window)

|

|

47

|

+

plot(no_trades ? 1 : 0, "NoTrades", display=display.data_window)

|

|

48

|

+

plot(rsi, "RSI", display=display.data_window)

|

|

49

|

+

plot(adx, "ADX", display=display.data_window)

|

|

50

|

+

|

|

51

|

+

// === DEBUG: INDICATOR DUMP ===

|

|

52

|

+

plot(macd_line, "d_MACDLine", display=display.data_window)

|

|

53

|

+

plot(signal_line, "d_SignalLine", display=display.data_window)

|

|

54

|

+

plot(macd_hist, "d_MACDHist", display=display.data_window)

|

|

55

|

+

plot(di_plus, "d_DIPlus", display=display.data_window)

|

|

56

|

+

plot(di_minus, "d_DIMinus", display=display.data_window)

|

|

57

|

+

plot(strong_trend ? 1 : 0, "d_StrongTrend", display=display.data_window)

|