mindee 4.1.2 → 4.3.0

This diff represents the content of publicly available package versions that have been released to one of the supported registries. The information contained in this diff is provided for informational purposes only and reflects changes between package versions as they appear in their respective public registries.

- checksums.yaml +4 -4

- data/CHANGELOG.md +13 -0

- data/bin/cli_products.rb +0 -6

- data/docs/global_products/expense_receipts_v5.md +1 -0

- data/docs/global_products/financial_document_v1.md +23 -4

- data/docs/global_products/invoices_v4.md +23 -4

- data/docs/localized_products/us_healthcare_cards_v1.md +17 -1

- data/lib/mindee/product/financial_document/financial_document_v1_document.rb +9 -1

- data/lib/mindee/product/financial_document/financial_document_v1_page.rb +1 -1

- data/lib/mindee/product/invoice/invoice_v4_document.rb +9 -1

- data/lib/mindee/product/invoice/invoice_v4_page.rb +1 -1

- data/lib/mindee/product/us/healthcare_card/healthcare_card_v1_copay.rb +2 -2

- data/lib/mindee/product/us/healthcare_card/healthcare_card_v1_copays.rb +2 -2

- data/lib/mindee/product/us/healthcare_card/healthcare_card_v1_document.rb +8 -3

- data/lib/mindee/product/us/healthcare_card/healthcare_card_v1_page.rb +1 -1

- data/lib/mindee/product.rb +0 -1

- data/lib/mindee/version.rb +1 -1

- data/sig/mindee/product/financial_document/financial_document_v1_document.rbs +1 -0

- data/sig/mindee/product/invoice/invoice_v4_document.rbs +1 -0

- data/sig/mindee/product/us/healthcare_card/healthcare_card_v1_document.rbs +1 -0

- metadata +2 -7

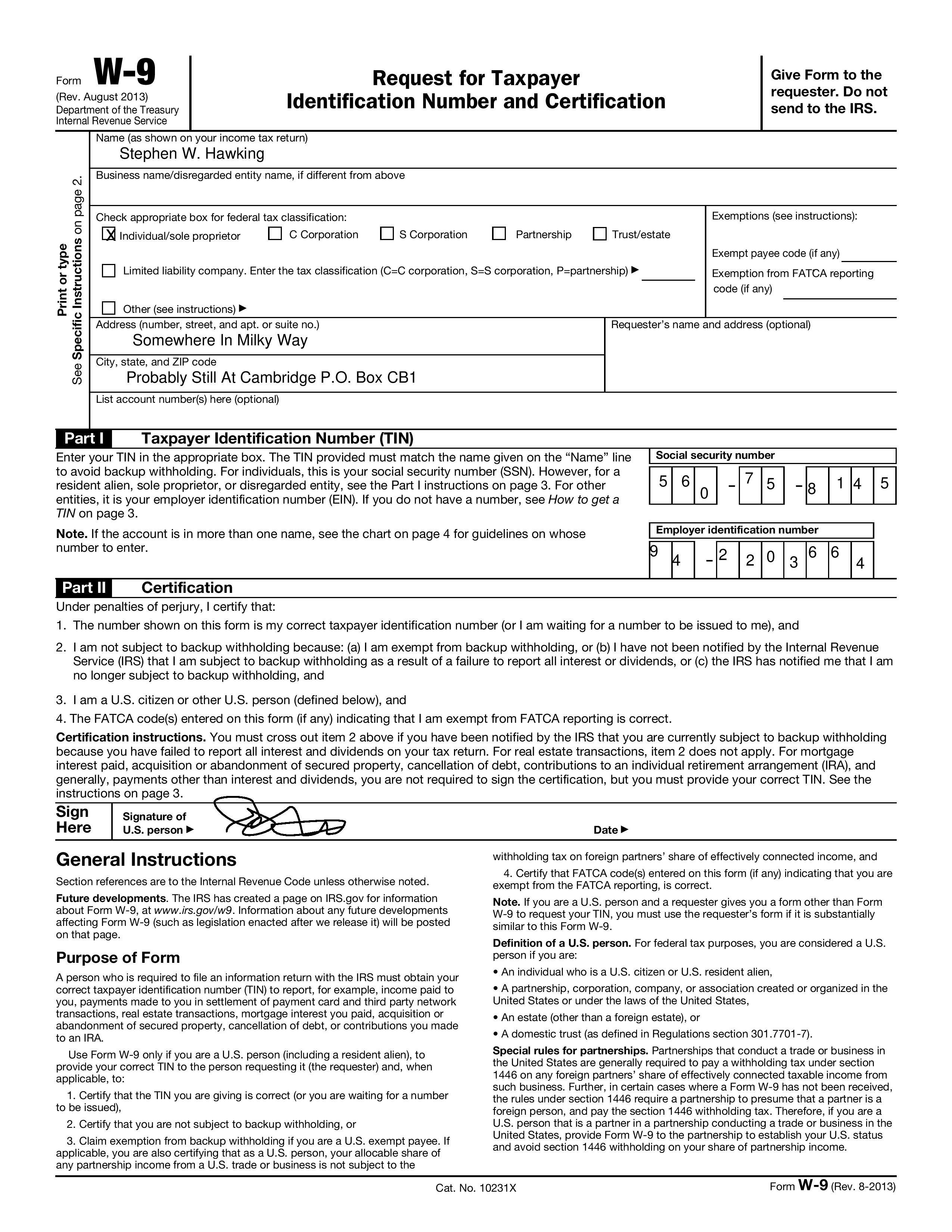

- data/docs/code_samples/us_w9_v1.txt +0 -21

- data/docs/localized_products/us_w9_v1.md +0 -230

- data/lib/mindee/product/us/w9/w9_v1.rb +0 -47

- data/lib/mindee/product/us/w9/w9_v1_document.rb +0 -15

- data/lib/mindee/product/us/w9/w9_v1_page.rb +0 -133

checksums.yaml

CHANGED

|

@@ -1,7 +1,7 @@

|

|

|

1

1

|

---

|

|

2

2

|

SHA256:

|

|

3

|

-

metadata.gz:

|

|

4

|

-

data.tar.gz:

|

|

3

|

+

metadata.gz: 05c6fc0946b9d844042798b1b01160d5fbbdfa69f7b4a4e02ffb79e062680671

|

|

4

|

+

data.tar.gz: 23bfb847706e7c3d9bb15cd0acae3aa25d33c8fbbd126d8a6db0d55a00cb268c

|

|

5

5

|

SHA512:

|

|

6

|

-

metadata.gz:

|

|

7

|

-

data.tar.gz:

|

|

6

|

+

metadata.gz: d693ccee678f81b71efaf221b6a5342e55e826458d345a9d5ae4f2d8644a729be6cd58b50e43481d12b5d8ed46afe02772acdc3c4b7f2fb9442de35e3d971b15

|

|

7

|

+

data.tar.gz: ee173692eff34f62deed6930e703d25996cdaf5910e5ff8a6ec6f771ad366af397122cb45f99a96755f0014a517b226c13f1c5a2af83588d1697f0599425a13f

|

data/CHANGELOG.md

CHANGED

|

@@ -1,5 +1,17 @@

|

|

|

1

1

|

# Mindee Ruby API Library Changelog

|

|

2

2

|

|

|

3

|

+

## v4.3.0 - 2025-04-08

|

|

4

|

+

### Changes

|

|

5

|

+

* :sparkles: add support for Financial Document V1.12

|

|

6

|

+

* :sparkles: add support for Invoices V4.10

|

|

7

|

+

* :sparkles: add support for US Healthcare Cards V1.2

|

|

8

|

+

|

|

9

|

+

|

|

10

|

+

## v4.2.0 - 2025-03-28

|

|

11

|

+

### Changes

|

|

12

|

+

* :coffin: remove support for US W9

|

|

13

|

+

|

|

14

|

+

|

|

3

15

|

## v4.1.2 - 2025-03-26

|

|

4

16

|

### Fixes

|

|

5

17

|

* :wrench: loosen version restrictions on most dependencies

|

|

@@ -18,6 +30,7 @@

|

|

|

18

30

|

### Fixes

|

|

19

31

|

* :recycle: update CLI syntax for easier product creation

|

|

20

32

|

|

|

33

|

+

|

|

21

34

|

## v4.0.0 - 2025-02-27

|

|

22

35

|

### ¡Breaking Changes!

|

|

23

36

|

* :boom: drop support for ruby versions < 3.0

|

data/bin/cli_products.rb

CHANGED

|

@@ -227,6 +227,7 @@ Aside from the basic `Field` attributes, the tax field `TaxField` also implement

|

|

|

227

227

|

* **rate** (`Float`): the tax rate applied to an item can be expressed as a percentage. Can be `nil`.

|

|

228

228

|

* **code** (`String`): tax code (or equivalent, depending on the origin of the document). Can be `nil`.

|

|

229

229

|

* **base** (`Float`): base amount used for the tax. Can be `nil`.

|

|

230

|

+

* **value** (`Float`): the value of the tax. Can be `nil`.

|

|

230

231

|

|

|

231

232

|

> Note: currently `TaxField` is not used on its own, and is accessed through a parent `Taxes` object, an array-like

|

|

232

233

|

structure.

|

|

@@ -12,7 +12,7 @@ The Ruby Client Library supports the [Financial Document API](https://platform.m

|

|

|

12

12

|

> | Specification | Details |

|

|

13

13

|

> | ------------------------------ | -------------------------------------------------- |

|

|

14

14

|

> | Endpoint Name | `financial_document` |

|

|

15

|

-

> | Recommended Version | `v1.

|

|

15

|

+

> | Recommended Version | `v1.12` |

|

|

16

16

|

> | Supports Polling/Webhooks | ✔️ Yes |

|

|

17

17

|

> | Support Synchronous HTTP Calls | ✔️ Yes |

|

|

18

18

|

> | Geography | 🌐 Global |

|

|

@@ -93,7 +93,7 @@ puts result.document

|

|

|

93

93

|

########

|

|

94

94

|

Document

|

|

95

95

|

########

|

|

96

|

-

:Mindee ID:

|

|

96

|

+

:Mindee ID: a80ac0ee-26f6-4e2e-988a-960b240d5ba7

|

|

97

97

|

:Filename: default_sample.jpg

|

|

98

98

|

|

|

99

99

|

Inference

|

|

@@ -118,7 +118,7 @@ Prediction

|

|

|

118

118

|

+---------------+--------+----------+---------------+

|

|

119

119

|

| Base | Code | Rate (%) | Amount |

|

|

120

120

|

+===============+========+==========+===============+

|

|

121

|

-

|

|

|

121

|

+

| 195.00 | | 5.00 | 9.75 |

|

|

122

122

|

+---------------+--------+----------+---------------+

|

|

123

123

|

:Supplier Payment Details:

|

|

124

124

|

:Supplier Name: JOHN SMITH

|

|

@@ -170,7 +170,7 @@ Page 0

|

|

|

170

170

|

+---------------+--------+----------+---------------+

|

|

171

171

|

| Base | Code | Rate (%) | Amount |

|

|

172

172

|

+===============+========+==========+===============+

|

|

173

|

-

|

|

|

173

|

+

| 195.00 | | 5.00 | 9.75 |

|

|

174

174

|

+---------------+--------+----------+---------------+

|

|

175

175

|

:Supplier Payment Details:

|

|

176

176

|

:Supplier Name: JOHN SMITH

|

|

@@ -272,6 +272,7 @@ Aside from the basic `Field` attributes, the tax field `TaxField` also implement

|

|

|

272

272

|

* **rate** (`Float`): the tax rate applied to an item can be expressed as a percentage. Can be `nil`.

|

|

273

273

|

* **code** (`String`): tax code (or equivalent, depending on the origin of the document). Can be `nil`.

|

|

274

274

|

* **base** (`Float`): base amount used for the tax. Can be `nil`.

|

|

275

|

+

* **value** (`Float`): the value of the tax. Can be `nil`.

|

|

275

276

|

|

|

276

277

|

> Note: currently `TaxField` is not used on its own, and is accessed through a parent `Taxes` object, an array-like

|

|

277

278

|

structure.

|

|

@@ -381,6 +382,24 @@ puts result.document.inference.prediction.document_number.value

|

|

|

381

382

|

puts result.document.inference.prediction.document_type.value

|

|

382

383

|

```

|

|

383

384

|

|

|

385

|

+

## Document Type Extended

|

|

386

|

+

**document_type_extended** ([ClassificationField](#classification-field)): Document type extended.

|

|

387

|

+

|

|

388

|

+

#### Possible values include:

|

|

389

|

+

- 'CREDIT NOTE'

|

|

390

|

+

- 'INVOICE'

|

|

391

|

+

- 'OTHER'

|

|

392

|

+

- 'OTHER_FINANCIAL'

|

|

393

|

+

- 'PAYSLIP'

|

|

394

|

+

- 'PURCHASE ORDER'

|

|

395

|

+

- 'QUOTE'

|

|

396

|

+

- 'RECEIPT'

|

|

397

|

+

- 'STATEMENT'

|

|

398

|

+

|

|

399

|

+

```rb

|

|

400

|

+

puts result.document.inference.prediction.document_type_extended.value

|

|

401

|

+

```

|

|

402

|

+

|

|

384

403

|

## Due Date

|

|

385

404

|

**due_date** ([DateField](#date-field)): The date on which the payment is due.

|

|

386

405

|

|

|

@@ -12,7 +12,7 @@ The Ruby Client Library supports the [Invoice API](https://platform.mindee.com/m

|

|

|

12

12

|

> | Specification | Details |

|

|

13

13

|

> | ------------------------------ | -------------------------------------------------- |

|

|

14

14

|

> | Endpoint Name | `invoices` |

|

|

15

|

-

> | Recommended Version | `v4.

|

|

15

|

+

> | Recommended Version | `v4.10` |

|

|

16

16

|

> | Supports Polling/Webhooks | ✔️ Yes |

|

|

17

17

|

> | Support Synchronous HTTP Calls | ✔️ Yes |

|

|

18

18

|

> | Geography | 🌐 Global |

|

|

@@ -93,7 +93,7 @@ puts result.document

|

|

|

93

93

|

########

|

|

94

94

|

Document

|

|

95

95

|

########

|

|

96

|

-

:Mindee ID:

|

|

96

|

+

:Mindee ID: b55db8f9-ae3b-4f05-b2f1-ec0ced5e5b70

|

|

97

97

|

:Filename: default_sample.jpg

|

|

98

98

|

|

|

99

99

|

Inference

|

|

@@ -117,7 +117,7 @@ Prediction

|

|

|

117

117

|

+---------------+--------+----------+---------------+

|

|

118

118

|

| Base | Code | Rate (%) | Amount |

|

|

119

119

|

+===============+========+==========+===============+

|

|

120

|

-

|

|

|

120

|

+

| 2145.00 | | 8.00 | 193.20 |

|

|

121

121

|

+---------------+--------+----------+---------------+

|

|

122

122

|

:Supplier Payment Details:

|

|

123

123

|

:Supplier Name: TURNPIKE DESIGNS

|

|

@@ -163,7 +163,7 @@ Page 0

|

|

|

163

163

|

+---------------+--------+----------+---------------+

|

|

164

164

|

| Base | Code | Rate (%) | Amount |

|

|

165

165

|

+===============+========+==========+===============+

|

|

166

|

-

|

|

|

166

|

+

| 2145.00 | | 8.00 | 193.20 |

|

|

167

167

|

+---------------+--------+----------+---------------+

|

|

168

168

|

:Supplier Payment Details:

|

|

169

169

|

:Supplier Name: TURNPIKE DESIGNS

|

|

@@ -260,6 +260,7 @@ Aside from the basic `Field` attributes, the tax field `TaxField` also implement

|

|

|

260

260

|

* **rate** (`Float`): the tax rate applied to an item can be expressed as a percentage. Can be `nil`.

|

|

261

261

|

* **code** (`String`): tax code (or equivalent, depending on the origin of the document). Can be `nil`.

|

|

262

262

|

* **base** (`Float`): base amount used for the tax. Can be `nil`.

|

|

263

|

+

* **value** (`Float`): the value of the tax. Can be `nil`.

|

|

263

264

|

|

|

264

265

|

> Note: currently `TaxField` is not used on its own, and is accessed through a parent `Taxes` object, an array-like

|

|

265

266

|

structure.

|

|

@@ -343,6 +344,24 @@ puts result.document.inference.prediction.date.value

|

|

|

343

344

|

puts result.document.inference.prediction.document_type.value

|

|

344

345

|

```

|

|

345

346

|

|

|

347

|

+

## Document Type Extended

|

|

348

|

+

**document_type_extended** ([ClassificationField](#classification-field)): Document type extended.

|

|

349

|

+

|

|

350

|

+

#### Possible values include:

|

|

351

|

+

- 'CREDIT NOTE'

|

|

352

|

+

- 'INVOICE'

|

|

353

|

+

- 'OTHER'

|

|

354

|

+

- 'OTHER_FINANCIAL'

|

|

355

|

+

- 'PAYSLIP'

|

|

356

|

+

- 'PURCHASE ORDER'

|

|

357

|

+

- 'QUOTE'

|

|

358

|

+

- 'RECEIPT'

|

|

359

|

+

- 'STATEMENT'

|

|

360

|

+

|

|

361

|

+

```rb

|

|

362

|

+

puts result.document.inference.prediction.document_type_extended.value

|

|

363

|

+

```

|

|

364

|

+

|

|

346

365

|

## Due Date

|

|

347

366

|

**due_date** ([DateField](#date-field)): The date on which the payment is due.

|

|

348

367

|

|

|

@@ -12,7 +12,7 @@ The Ruby Client Library supports the [Healthcare Card API](https://platform.mind

|

|

|

12

12

|

> | Specification | Details |

|

|

13

13

|

> | ------------------------------ | -------------------------------------------------- |

|

|

14

14

|

> | Endpoint Name | `us_healthcare_cards` |

|

|

15

|

-

> | Recommended Version | `v1.

|

|

15

|

+

> | Recommended Version | `v1.2` |

|

|

16

16

|

> | Supports Polling/Webhooks | ✔️ Yes |

|

|

17

17

|

> | Support Synchronous HTTP Calls | ❌ No |

|

|

18

18

|

> | Geography | 🇺🇸 United States |

|

|

@@ -138,6 +138,15 @@ A `HealthcareCardV1Copay` implements the following attributes:

|

|

|

138

138

|

* `service_fees` (Float): The price of service.

|

|

139

139

|

* `service_name` (String): The name of service of the copay.

|

|

140

140

|

|

|

141

|

+

#### Possible values include:

|

|

142

|

+

- primary_care

|

|

143

|

+

- emergency_room

|

|

144

|

+

- urgent_care

|

|

145

|

+

- specialist

|

|

146

|

+

- office_visit

|

|

147

|

+

- prescription

|

|

148

|

+

|

|

149

|

+

|

|

141

150

|

# Attributes

|

|

142

151

|

The following fields are extracted for Healthcare Card V1:

|

|

143

152

|

|

|

@@ -222,6 +231,13 @@ puts result.document.inference.prediction.rx_bin.value

|

|

|

222

231

|

puts result.document.inference.prediction.rx_grp.value

|

|

223

232

|

```

|

|

224

233

|

|

|

234

|

+

## RX ID

|

|

235

|

+

**rx_id** ([StringField](#string-field)): The ID number for prescription drug coverage.

|

|

236

|

+

|

|

237

|

+

```rb

|

|

238

|

+

puts result.document.inference.prediction.rx_id.value

|

|

239

|

+

```

|

|

240

|

+

|

|

225

241

|

## RX PCN

|

|

226

242

|

**rx_pcn** ([StringField](#string-field)): The PCN number for prescription drug coverage.

|

|

227

243

|

|

|

@@ -6,7 +6,7 @@ require_relative 'financial_document_v1_line_items'

|

|

|

6

6

|

module Mindee

|

|

7

7

|

module Product

|

|

8

8

|

module FinancialDocument

|

|

9

|

-

# Financial Document API version 1.

|

|

9

|

+

# Financial Document API version 1.12 document data.

|

|

10

10

|

class FinancialDocumentV1Document < Mindee::Parsing::Common::Prediction

|

|

11

11

|

include Mindee::Parsing::Standard

|

|

12

12

|

# The customer's address used for billing.

|

|

@@ -37,6 +37,9 @@ module Mindee

|

|

|

37

37

|

# RECEIPT if it is a receipt.

|

|

38

38

|

# @return [Mindee::Parsing::Standard::ClassificationField]

|

|

39

39

|

attr_reader :document_type

|

|

40

|

+

# Document type extended.

|

|

41

|

+

# @return [Mindee::Parsing::Standard::ClassificationField]

|

|

42

|

+

attr_reader :document_type_extended

|

|

40

43

|

# The date on which the payment is due.

|

|

41

44

|

# @return [Mindee::Parsing::Standard::DateField]

|

|

42

45

|

attr_reader :due_date

|

|

@@ -144,6 +147,10 @@ module Mindee

|

|

|

144

147

|

prediction['document_type'],

|

|

145

148

|

page_id

|

|

146

149

|

)

|

|

150

|

+

@document_type_extended = Parsing::Standard::ClassificationField.new(

|

|

151

|

+

prediction['document_type_extended'],

|

|

152

|

+

page_id

|

|

153

|

+

)

|

|

147

154

|

@due_date = Parsing::Standard::DateField.new(

|

|

148

155

|

prediction['due_date'],

|

|

149

156

|

page_id

|

|

@@ -262,6 +269,7 @@ module Mindee

|

|

|

262

269

|

out_str << "\n:Shipping Address: #{@shipping_address}".rstrip

|

|

263

270

|

out_str << "\n:Billing Address: #{@billing_address}".rstrip

|

|

264

271

|

out_str << "\n:Document Type: #{@document_type}".rstrip

|

|

272

|

+

out_str << "\n:Document Type Extended: #{@document_type_extended}".rstrip

|

|

265

273

|

out_str << "\n:Purchase Subcategory: #{@subcategory}".rstrip

|

|

266

274

|

out_str << "\n:Purchase Category: #{@category}".rstrip

|

|

267

275

|

out_str << "\n:Total Tax: #{@total_tax}".rstrip

|

|

@@ -6,7 +6,7 @@ require_relative 'financial_document_v1_document'

|

|

|

6

6

|

module Mindee

|

|

7

7

|

module Product

|

|

8

8

|

module FinancialDocument

|

|

9

|

-

# Financial Document API version 1.

|

|

9

|

+

# Financial Document API version 1.12 page data.

|

|

10

10

|

class FinancialDocumentV1Page < Mindee::Parsing::Common::Page

|

|

11

11

|

# @param prediction [Hash]

|

|

12

12

|

def initialize(prediction)

|

|

@@ -6,7 +6,7 @@ require_relative 'invoice_v4_line_items'

|

|

|

6

6

|

module Mindee

|

|

7

7

|

module Product

|

|

8

8

|

module Invoice

|

|

9

|

-

# Invoice API version 4.

|

|

9

|

+

# Invoice API version 4.10 document data.

|

|

10

10

|

class InvoiceV4Document < Mindee::Parsing::Common::Prediction

|

|

11

11

|

include Mindee::Parsing::Standard

|

|

12

12

|

# The customer billing address.

|

|

@@ -30,6 +30,9 @@ module Mindee

|

|

|

30

30

|

# Document type: INVOICE or CREDIT NOTE.

|

|

31

31

|

# @return [Mindee::Parsing::Standard::ClassificationField]

|

|

32

32

|

attr_reader :document_type

|

|

33

|

+

# Document type extended.

|

|

34

|

+

# @return [Mindee::Parsing::Standard::ClassificationField]

|

|

35

|

+

attr_reader :document_type_extended

|

|

33

36

|

# The date on which the payment is due.

|

|

34

37

|

# @return [Mindee::Parsing::Standard::DateField]

|

|

35

38

|

attr_reader :due_date

|

|

@@ -117,6 +120,10 @@ module Mindee

|

|

|

117

120

|

prediction['document_type'],

|

|

118

121

|

page_id

|

|

119

122

|

)

|

|

123

|

+

@document_type_extended = Parsing::Standard::ClassificationField.new(

|

|

124

|

+

prediction['document_type_extended'],

|

|

125

|

+

page_id

|

|

126

|

+

)

|

|

120

127

|

@due_date = Parsing::Standard::DateField.new(

|

|

121

128

|

prediction['due_date'],

|

|

122

129

|

page_id

|

|

@@ -222,6 +229,7 @@ module Mindee

|

|

|

222

229

|

out_str << "\n:Shipping Address: #{@shipping_address}".rstrip

|

|

223

230

|

out_str << "\n:Billing Address: #{@billing_address}".rstrip

|

|

224

231

|

out_str << "\n:Document Type: #{@document_type}".rstrip

|

|

232

|

+

out_str << "\n:Document Type Extended: #{@document_type_extended}".rstrip

|

|

225

233

|

out_str << "\n:Line Items:"

|

|

226

234

|

out_str << line_items

|

|

227

235

|

out_str[1..].to_s

|

|

@@ -6,7 +6,7 @@ require_relative 'invoice_v4_document'

|

|

|

6

6

|

module Mindee

|

|

7

7

|

module Product

|

|

8

8

|

module Invoice

|

|

9

|

-

# Invoice API version 4.

|

|

9

|

+

# Invoice API version 4.10 page data.

|

|

10

10

|

class InvoiceV4Page < Mindee::Parsing::Common::Page

|

|

11

11

|

# @param prediction [Hash]

|

|

12

12

|

def initialize(prediction)

|

|

@@ -39,7 +39,7 @@ module Mindee

|

|

|

39

39

|

printable = {}

|

|

40

40

|

printable[:service_fees] =

|

|

41

41

|

@service_fees.nil? ? '' : Parsing::Standard::BaseField.float_to_string(@service_fees)

|

|

42

|

-

printable[:service_name] = format_for_display(@service_name,

|

|

42

|

+

printable[:service_name] = format_for_display(@service_name, 20)

|

|

43

43

|

printable

|

|

44

44

|

end

|

|

45

45

|

|

|

@@ -48,7 +48,7 @@ module Mindee

|

|

|

48

48

|

printable = table_printable_values

|

|

49

49

|

out_str = String.new

|

|

50

50

|

out_str << format('| %- 13s', printable[:service_fees])

|

|

51

|

-

out_str << format('| %-

|

|

51

|

+

out_str << format('| %- 21s', printable[:service_name])

|

|

52

52

|

out_str << '|'

|

|

53

53

|

end

|

|

54

54

|

|

|

@@ -27,7 +27,7 @@ module Mindee

|

|

|

27

27

|

def self.line_items_separator(char)

|

|

28

28

|

out_str = String.new

|

|

29

29

|

out_str << "+#{char * 14}"

|

|

30

|

-

out_str << "+#{char *

|

|

30

|

+

out_str << "+#{char * 22}"

|

|

31

31

|

out_str

|

|

32

32

|

end

|

|

33

33

|

|

|

@@ -41,7 +41,7 @@ module Mindee

|

|

|

41

41

|

out_str = String.new

|

|

42

42

|

out_str << ("\n#{self.class.line_items_separator('-')}\n ")

|

|

43

43

|

out_str << ' | Service Fees'

|

|

44

|

-

out_str << ' | Service Name'

|

|

44

|

+

out_str << ' | Service Name '

|

|

45

45

|

out_str << (" |\n#{self.class.line_items_separator('=')}")

|

|

46

46

|

out_str + lines

|

|

47

47

|

end

|

|

@@ -7,7 +7,7 @@ module Mindee

|

|

|

7

7

|

module Product

|

|

8

8

|

module US

|

|

9

9

|

module HealthcareCard

|

|

10

|

-

# Healthcare Card API version 1.

|

|

10

|

+

# Healthcare Card API version 1.2 document data.

|

|

11

11

|

class HealthcareCardV1Document < Mindee::Parsing::Common::Prediction

|

|

12

12

|

include Mindee::Parsing::Standard

|

|

13

13

|

# The name of the company that provides the healthcare plan.

|

|

@@ -43,6 +43,9 @@ module Mindee

|

|

|

43

43

|

# The group number for prescription drug coverage.

|

|

44

44

|

# @return [Mindee::Parsing::Standard::StringField]

|

|

45

45

|

attr_reader :rx_grp

|

|

46

|

+

# The ID number for prescription drug coverage.

|

|

47

|

+

# @return [Mindee::Parsing::Standard::StringField]

|

|

48

|

+

attr_reader :rx_id

|

|

46

49

|

# The PCN number for prescription drug coverage.

|

|

47

50

|

# @return [Mindee::Parsing::Standard::StringField]

|

|

48

51

|

attr_reader :rx_pcn

|

|

@@ -92,6 +95,7 @@ module Mindee

|

|

|

92

95

|

prediction['rx_grp'],

|

|

93

96

|

page_id

|

|

94

97

|

)

|

|

98

|

+

@rx_id = Parsing::Standard::StringField.new(prediction['rx_id'], page_id)

|

|

95

99

|

@rx_pcn = Parsing::Standard::StringField.new(

|

|

96

100

|

prediction['rx_pcn'],

|

|

97

101

|

page_id

|

|

@@ -111,6 +115,7 @@ module Mindee

|

|

|

111

115

|

out_str << "\n:Group Number: #{@group_number}".rstrip

|

|

112

116

|

out_str << "\n:Payer ID: #{@payer_id}".rstrip

|

|

113

117

|

out_str << "\n:RX BIN: #{@rx_bin}".rstrip

|

|

118

|

+

out_str << "\n:RX ID: #{@rx_id}".rstrip

|

|

114

119

|

out_str << "\n:RX GRP: #{@rx_grp}".rstrip

|

|

115

120

|

out_str << "\n:RX PCN: #{@rx_pcn}".rstrip

|

|

116

121

|

out_str << "\n:copays:"

|

|

@@ -127,7 +132,7 @@ module Mindee

|

|

|

127

132

|

out_str = String.new

|

|

128

133

|

out_str << ' '

|

|

129

134

|

out_str << "+#{char * 14}"

|

|

130

|

-

out_str << "+#{char *

|

|

135

|

+

out_str << "+#{char * 22}"

|

|

131

136

|

out_str << '+'

|

|

132

137

|

out_str

|

|

133

138

|

end

|

|

@@ -141,7 +146,7 @@ module Mindee

|

|

|

141

146

|

out_str << "\n#{copays_separator('-')}"

|

|

142

147

|

out_str << "\n |"

|

|

143

148

|

out_str << ' Service Fees |'

|

|

144

|

-

out_str << ' Service Name

|

|

149

|

+

out_str << ' Service Name |'

|

|

145

150

|

out_str << "\n#{copays_separator('=')}"

|

|

146

151

|

out_str << "\n #{line_items}"

|

|

147

152

|

out_str << "\n#{copays_separator('-')}"

|

|

@@ -7,7 +7,7 @@ module Mindee

|

|

|

7

7

|

module Product

|

|

8

8

|

module US

|

|

9

9

|

module HealthcareCard

|

|

10

|

-

# Healthcare Card API version 1.

|

|

10

|

+

# Healthcare Card API version 1.2 page data.

|

|

11

11

|

class HealthcareCardV1Page < Mindee::Parsing::Common::Page

|

|

12

12

|

# @param prediction [Hash]

|

|

13

13

|

def initialize(prediction)

|

data/lib/mindee/product.rb

CHANGED

data/lib/mindee/version.rb

CHANGED

|

@@ -14,6 +14,7 @@ module Mindee

|

|

|

14

14

|

def date: -> (Parsing::Standard::DateField)

|

|

15

15

|

def document_number: -> (Parsing::Standard::StringField)

|

|

16

16

|

def document_type: -> (Parsing::Standard::ClassificationField)

|

|

17

|

+

def document_type_extended: -> (Parsing::Standard::ClassificationField)

|

|

17

18

|

def due_date: -> (Parsing::Standard::DateField)

|

|

18

19

|

def invoice_number: -> (Parsing::Standard::StringField)

|

|

19

20

|

def line_items: -> (Product::FinancialDocument::FinancialDocumentV1LineItems)

|

|

@@ -12,6 +12,7 @@ module Mindee

|

|

|

12

12

|

def customer_name: -> (Parsing::Standard::StringField)

|

|

13

13

|

def date: -> (Parsing::Standard::DateField)

|

|

14

14

|

def document_type: -> (Parsing::Standard::ClassificationField)

|

|

15

|

+

def document_type_extended: -> (Parsing::Standard::ClassificationField)

|

|

15

16

|

def due_date: -> (Parsing::Standard::DateField)

|

|

16

17

|

def invoice_number: -> (Parsing::Standard::StringField)

|

|

17

18

|

def line_items: -> (Product::Invoice::InvoiceV4LineItems)

|

|

@@ -17,6 +17,7 @@ module Mindee

|

|

|

17

17

|

def payer_id: -> (Parsing::Standard::StringField)

|

|

18

18

|

def rx_bin: -> (Parsing::Standard::StringField)

|

|

19

19

|

def rx_grp: -> (Parsing::Standard::StringField)

|

|

20

|

+

def rx_id: -> (Parsing::Standard::StringField)

|

|

20

21

|

def rx_pcn: -> (Parsing::Standard::StringField)

|

|

21

22

|

def copays_separator: (String) -> String

|

|

22

23

|

def copays_to_s: -> String

|

metadata

CHANGED

|

@@ -1,14 +1,14 @@

|

|

|

1

1

|

--- !ruby/object:Gem::Specification

|

|

2

2

|

name: mindee

|

|

3

3

|

version: !ruby/object:Gem::Version

|

|

4

|

-

version: 4.

|

|

4

|

+

version: 4.3.0

|

|

5

5

|

platform: ruby

|

|

6

6

|

authors:

|

|

7

7

|

- Mindee, SA

|

|

8

8

|

autorequire:

|

|

9

9

|

bindir: bin

|

|

10

10

|

cert_chain: []

|

|

11

|

-

date: 2025-

|

|

11

|

+

date: 2025-04-08 00:00:00.000000000 Z

|

|

12

12

|

dependencies:

|

|

13

13

|

- !ruby/object:Gem::Dependency

|

|

14

14

|

name: base64

|

|

@@ -245,7 +245,6 @@ files:

|

|

|

245

245

|

- docs/code_samples/us_healthcare_cards_v1_async.txt

|

|

246

246

|

- docs/code_samples/us_mail_v2_async.txt

|

|

247

247

|

- docs/code_samples/us_mail_v3_async.txt

|

|

248

|

-

- docs/code_samples/us_w9_v1.txt

|

|

249

248

|

- docs/code_samples/workflow_execution.txt

|

|

250

249

|

- docs/getting_started.md

|

|

251

250

|

- docs/global_products.md

|

|

@@ -278,7 +277,6 @@ files:

|

|

|

278

277

|

- docs/localized_products/payslip_fra_v3.md

|

|

279

278

|

- docs/localized_products/us_healthcare_cards_v1.md

|

|

280

279

|

- docs/localized_products/us_mail_v3.md

|

|

281

|

-

- docs/localized_products/us_w9_v1.md

|

|

282

280

|

- examples/auto_invoice_splitter_extraction.rb

|

|

283

281

|

- examples/auto_multi_receipts_detector_extraction.rb

|

|

284

282

|

- lib/mindee.rb

|

|

@@ -535,9 +533,6 @@ files:

|

|

|

535

533

|

- lib/mindee/product/us/us_mail/us_mail_v3_recipient_address.rb

|

|

536

534

|

- lib/mindee/product/us/us_mail/us_mail_v3_recipient_addresses.rb

|

|

537

535

|

- lib/mindee/product/us/us_mail/us_mail_v3_sender_address.rb

|

|

538

|

-

- lib/mindee/product/us/w9/w9_v1.rb

|

|

539

|

-

- lib/mindee/product/us/w9/w9_v1_document.rb

|

|

540

|

-

- lib/mindee/product/us/w9/w9_v1_page.rb

|

|

541

536

|

- lib/mindee/version.rb

|

|

542

537

|

- mindee.gemspec

|

|

543

538

|

- sig/custom/marcel.rbs

|

|

@@ -1,21 +0,0 @@

|

|

|

1

|

-

#

|

|

2

|

-

# Install the Ruby client library by running:

|

|

3

|

-

# gem install mindee

|

|

4

|

-

#

|

|

5

|

-

|

|

6

|

-

require 'mindee'

|

|

7

|

-

|

|

8

|

-

# Init a new client

|

|

9

|

-

mindee_client = Mindee::Client.new(api_key: 'my-api-key')

|

|

10

|

-

|

|

11

|

-

# Load a file from disk

|

|

12

|

-

input_source = mindee_client.source_from_path('/path/to/the/file.ext')

|

|

13

|

-

|

|

14

|

-

# Parse the file

|

|

15

|

-

result = mindee_client.parse(

|

|

16

|

-

input_source,

|

|

17

|

-

Mindee::Product::US::W9::W9V1

|

|

18

|

-

)

|

|

19

|

-

|

|

20

|

-

# Print a full summary of the parsed data in RST format

|

|

21

|

-

puts result.document

|

|

@@ -1,230 +0,0 @@

|

|

|

1

|

-

---

|

|

2

|

-

title: US W9

|

|

3

|

-

category: 622b805aaec68102ea7fcbc2

|

|

4

|

-

slug: ruby-us-w9-ocr

|

|

5

|

-

parentDoc: 67b49e29a2cd6f08d69a40d8

|

|

6

|

-

---

|

|

7

|

-

The Ruby Client Library supports the [W9 API](https://platform.mindee.com/mindee/us_w9).

|

|

8

|

-

|

|

9

|

-

|

|

10

|

-

> 📝 Product Specs

|

|

11

|

-

>

|

|

12

|

-

> | Specification | Details |

|

|

13

|

-

> | ------------------------------ | -------------------------------------------------- |

|

|

14

|

-

> | Endpoint Name | `us_w9` |

|

|

15

|

-

> | Recommended Version | `v1.0` |

|

|

16

|

-

> | Supports Polling/Webhooks | ❌ No |

|

|

17

|

-

> | Support Synchronous HTTP Calls | ✔️ Yes |

|

|

18

|

-

> | Geography | 🇺🇸 United States |

|

|

19

|

-

|

|

20

|

-

|

|

21

|

-

Using the [sample below](https://github.com/mindee/client-lib-test-data/blob/main/products/us_w9/default_sample.jpg),

|

|

22

|

-

we are going to illustrate how to extract the data that we want using the Ruby Client Library.

|

|

23

|

-

|

|

24

|

-

|

|

25

|

-

# Quick-Start

|

|

26

|

-

```rb

|

|

27

|

-

#

|

|

28

|

-

# Install the Ruby client library by running:

|

|

29

|

-

# gem install mindee

|

|

30

|

-

#

|

|

31

|

-

|

|

32

|

-

require 'mindee'

|

|

33

|

-

|

|

34

|

-

# Init a new client

|

|

35

|

-

mindee_client = Mindee::Client.new(api_key: 'my-api-key')

|

|

36

|

-

|

|

37

|

-

# Load a file from disk

|

|

38

|

-

input_source = mindee_client.source_from_path('/path/to/the/file.ext')

|

|

39

|

-

|

|

40

|

-

# Parse the file

|

|

41

|

-

result = mindee_client.parse(

|

|

42

|

-

input_source,

|

|

43

|

-

Mindee::Product::US::W9::W9V1

|

|

44

|

-

)

|

|

45

|

-

|

|

46

|

-

# Print a full summary of the parsed data in RST format

|

|

47

|

-

puts result.document

|

|

48

|

-

```

|

|

49

|

-

|

|

50

|

-

**Output (RST):**

|

|

51

|

-

```rst

|

|

52

|

-

########

|

|

53

|

-

Document

|

|

54

|

-

########

|

|

55

|

-

:Mindee ID: d7c5b25f-e0d3-4491-af54-6183afa1aaab

|

|

56

|

-

:Filename: default_sample.jpg

|

|

57

|

-

|

|

58

|

-

Inference

|

|

59

|

-

#########

|

|

60

|

-

:Product: mindee/us_w9 v1.0

|

|

61

|

-

:Rotation applied: Yes

|

|

62

|

-

|

|

63

|

-

Prediction

|

|

64

|

-

==========

|

|

65

|

-

|

|

66

|

-

Page Predictions

|

|

67

|

-

================

|

|

68

|

-

|

|

69

|

-

Page 0

|

|

70

|

-

------

|

|

71

|

-

:Name: Stephen W Hawking

|

|

72

|

-

:SSN: 560758145

|

|

73

|

-

:Address: Somewhere In Milky Way

|

|

74

|

-

:City State Zip: Probably Still At Cambridge P O Box CB1

|

|

75

|

-

:Business Name:

|

|

76

|

-

:EIN: 942203664

|

|

77

|

-

:Tax Classification: individual

|

|

78

|

-

:Tax Classification Other Details:

|

|

79

|

-

:W9 Revision Date: august 2013

|

|

80

|

-

:Signature Position: Polygon with 4 points.

|

|

81

|

-

:Signature Date Position:

|

|

82

|

-

:Tax Classification LLC:

|

|

83

|

-

```

|

|

84

|

-

|

|

85

|

-

# Field Types

|

|

86

|

-

## Standard Fields

|

|

87

|

-

These fields are generic and used in several products.

|

|

88

|

-

|

|

89

|

-

### Basic Field

|

|

90

|

-

Each prediction object contains a set of fields that inherit from the generic `Field` class.

|

|

91

|

-

A typical `Field` object will have the following attributes:

|

|

92

|

-

|

|

93

|

-

* **value** (`String`, `Float`, `Integer`, `bool`): corresponds to the field value. Can be `nil` if no value was extracted.

|

|

94

|

-

* **confidence** (Float, nil): the confidence score of the field prediction.

|

|

95

|

-

* **bounding_box** (`Mindee::Geometry::Quadrilateral`, `nil`): contains exactly 4 relative vertices (points) coordinates of a right rectangle containing the field in the document.

|

|

96

|

-

* **polygon** (`Mindee::Geometry::Polygon`, `nil`): contains the relative vertices coordinates (`Point`) of a polygon containing the field in the image.

|

|

97

|

-

* **page_id** (`Integer`, `nil`): the ID of the page, always `nil` when at document-level.

|

|

98

|

-

* **reconstructed** (`bool`): indicates whether an object was reconstructed (not extracted as the API gave it).

|

|

99

|

-

|

|

100

|

-

|

|

101

|

-

Aside from the previous attributes, all basic fields have access to a `to_s` method that can be used to print their value as a string.

|

|

102

|

-

|

|

103

|

-

|

|

104

|

-

### Position Field

|

|

105

|

-

The position field `PositionField` does not implement all the basic `Field` attributes, only **bounding_box**,

|

|

106

|

-

**polygon** and **page_id**. On top of these, it has access to:

|

|

107

|

-

|

|

108

|

-

* **rectangle** (`Mindee::Geometry::Quadrilateral`): a Polygon with four points that may be oriented (even beyond

|

|

109

|

-

canvas).

|

|

110

|

-

* **quadrangle** (`Mindee::Geometry::Quadrilateral`): a free polygon made up of four points.

|

|

111

|

-

|

|

112

|

-

### String Field

|

|

113

|

-

The text field `StringField` only has one constraint: it's **value** is a `String` (or `nil`).

|

|

114

|

-

|

|

115

|

-

## Page-Level Fields

|

|

116

|

-

Some fields are constrained to the page level, and so will not be retrievable at document level.

|

|

117

|

-

|

|

118

|

-

# Attributes

|

|

119

|

-

The following fields are extracted for W9 V1:

|

|

120

|

-

|

|

121

|

-

## Address

|

|

122

|

-

[📄](#page-level-fields "This field is only present on individual pages.")**address** ([StringField](#string-field)): The street address (number, street, and apt. or suite no.) of the applicant.

|

|

123

|

-

|

|

124

|

-

```rb

|

|

125

|

-

result.document.address.each do |address_elem|

|

|

126

|

-

puts address_elem.value

|

|

127

|

-

end

|

|

128

|

-

```

|

|

129

|

-

|

|

130

|

-

## Business Name

|

|

131

|

-

[📄](#page-level-fields "This field is only present on individual pages.")**business_name** ([StringField](#string-field)): The business name or disregarded entity name, if different from Name.

|

|

132

|

-

|

|

133

|

-

```rb

|

|

134

|

-

result.document.business_name.each do |business_name_elem|

|

|

135

|

-

puts business_name_elem.value

|

|

136

|

-

end

|

|

137

|

-

```

|

|

138

|

-

|

|

139

|

-

## City State Zip

|

|

140

|

-

[📄](#page-level-fields "This field is only present on individual pages.")**city_state_zip** ([StringField](#string-field)): The city, state, and ZIP code of the applicant.

|

|

141

|

-

|

|

142

|

-

```rb

|

|

143

|

-

result.document.city_state_zip.each do |city_state_zip_elem|

|

|

144

|

-

puts city_state_zip_elem.value

|

|

145

|

-

end

|

|

146

|

-

```

|

|

147

|

-

|

|

148

|

-

## EIN

|

|

149

|

-

[📄](#page-level-fields "This field is only present on individual pages.")**ein** ([StringField](#string-field)): The employer identification number.

|

|

150

|

-

|

|

151

|

-

```rb

|

|

152

|

-

result.document.ein.each do |ein_elem|

|

|

153

|

-

puts ein_elem.value

|

|

154

|

-

end

|

|

155

|

-

```

|

|

156

|

-

|

|

157

|

-

## Name

|

|

158

|

-

[📄](#page-level-fields "This field is only present on individual pages.")**name** ([StringField](#string-field)): Name as shown on the applicant's income tax return.

|

|

159

|

-

|

|

160

|

-

```rb

|

|

161

|

-

result.document.name.each do |name_elem|

|

|

162

|

-

puts name_elem.value

|

|

163

|

-

end

|

|

164

|

-

```

|

|

165

|

-

|

|

166

|

-

## Signature Date Position

|

|

167

|

-

[📄](#page-level-fields "This field is only present on individual pages.")**signature_date_position** ([PositionField](#position-field)): Position of the signature date on the document.

|

|

168

|

-

|

|

169

|

-

```rb

|

|

170

|

-

result.document.signature_date_position.each do |signature_date_position_elem|

|

|

171

|

-

puts signature_date_position_elem.polygon

|

|

172

|

-

end

|

|

173

|

-

```

|

|

174

|

-

|

|

175

|

-

## Signature Position

|

|

176

|

-

[📄](#page-level-fields "This field is only present on individual pages.")**signature_position** ([PositionField](#position-field)): Position of the signature on the document.

|

|

177

|

-

|

|

178

|

-

```rb

|

|

179

|

-

result.document.signature_position.each do |signature_position_elem|

|

|

180

|

-

puts signature_position_elem.polygon

|

|

181

|

-

end

|

|

182

|

-

```

|

|

183

|

-

|

|

184

|

-

## SSN

|

|

185

|

-

[📄](#page-level-fields "This field is only present on individual pages.")**ssn** ([StringField](#string-field)): The applicant's social security number.

|

|

186

|

-

|

|

187

|

-

```rb

|

|

188

|

-

result.document.ssn.each do |ssn_elem|

|

|

189

|

-

puts ssn_elem.value

|

|

190

|

-

end

|

|

191

|

-

```

|

|

192

|

-

|

|

193

|

-

## Tax Classification

|

|

194

|

-

[📄](#page-level-fields "This field is only present on individual pages.")**tax_classification** ([StringField](#string-field)): The federal tax classification, which can vary depending on the revision date.

|

|

195

|

-

|

|

196

|

-

```rb

|

|

197

|

-

result.document.tax_classification.each do |tax_classification_elem|

|

|

198

|

-

puts tax_classification_elem.value

|

|

199

|

-

end

|

|

200

|

-

```

|

|

201

|

-

|

|

202

|

-

## Tax Classification LLC

|

|

203

|

-

[📄](#page-level-fields "This field is only present on individual pages.")**tax_classification_llc** ([StringField](#string-field)): Depending on revision year, among S, C, P or D for Limited Liability Company Classification.

|

|

204

|

-

|

|

205

|

-

```rb

|

|

206

|

-

result.document.tax_classification_llc.each do |tax_classification_llc_elem|

|

|

207

|

-

puts tax_classification_llc_elem.value

|

|

208

|

-

end

|

|

209

|

-

```

|

|

210

|

-

|

|

211

|

-

## Tax Classification Other Details

|

|

212

|

-

[📄](#page-level-fields "This field is only present on individual pages.")**tax_classification_other_details** ([StringField](#string-field)): Tax Classification Other Details.

|

|

213

|

-

|

|

214

|

-

```rb

|

|

215

|

-

result.document.tax_classification_other_details.each do |tax_classification_other_details_elem|

|

|

216

|

-

puts tax_classification_other_details_elem.value

|

|

217

|

-

end

|

|

218

|

-

```

|

|

219

|

-

|

|

220

|

-

## W9 Revision Date

|

|

221

|

-

[📄](#page-level-fields "This field is only present on individual pages.")**w9_revision_date** ([StringField](#string-field)): The Revision month and year of the W9 form.

|

|

222

|

-

|

|

223

|

-

```rb

|

|

224

|

-

result.document.w9_revision_date.each do |w9_revision_date_elem|

|

|

225

|

-

puts w9_revision_date_elem.value

|

|

226

|

-

end

|

|

227

|

-

```

|

|

228

|

-

|

|

229

|

-

# Questions?

|

|

230

|

-

[Join our Slack](https://join.slack.com/t/mindee-community/shared_invite/zt-2d0ds7dtz-DPAF81ZqTy20chsYpQBW5g)

|

|

@@ -1,47 +0,0 @@

|

|

|

1

|

-

# frozen_string_literal: true

|

|

2

|

-

|

|

3

|

-

require_relative '../../../parsing'

|

|

4

|

-

require_relative 'w9_v1_document'

|

|

5

|

-

require_relative 'w9_v1_page'

|

|

6

|

-

|

|

7

|

-

module Mindee

|

|

8

|

-

module Product

|

|

9

|

-

module US

|

|

10

|

-

# W9 module.

|

|

11

|

-

module W9

|

|

12

|

-

# W9 API version 1 inference prediction.

|

|

13

|

-

class W9V1 < Mindee::Parsing::Common::Inference

|

|

14

|

-

@endpoint_name = 'us_w9'

|

|

15

|

-

@endpoint_version = '1'

|

|

16

|

-

@has_async = false

|

|

17

|

-

@has_sync = true

|

|

18

|

-

|

|

19

|

-

# @param prediction [Hash]

|

|

20

|

-

def initialize(prediction)

|

|

21

|

-

super

|

|

22

|

-

@prediction = W9V1Document.new(prediction['prediction'], nil)

|

|

23

|

-

@pages = []

|

|

24

|

-

prediction['pages'].each do |page|

|

|

25

|

-

@pages.push(W9V1Page.new(page))

|

|

26

|

-

end

|

|

27

|

-

end

|

|

28

|

-

|

|

29

|

-

class << self

|

|

30

|

-

# Name of the endpoint for this product.

|

|

31

|

-

# @return [String]

|

|

32

|

-

attr_reader :endpoint_name

|

|

33

|

-

# Version for this product.

|

|

34

|

-

# @return [String]

|

|

35

|

-

attr_reader :endpoint_version

|

|

36

|

-

# Whether this product has access to an asynchronous endpoint.

|

|

37

|

-

# @return [bool]

|

|

38

|

-

attr_reader :has_async

|

|

39

|

-

# Whether this product has access to synchronous endpoint.

|

|

40

|

-

# @return [bool]

|

|

41

|

-

attr_reader :has_sync

|

|

42

|

-

end

|

|

43

|

-

end

|

|

44

|

-

end

|

|

45

|

-

end

|

|

46

|

-

end

|

|

47

|

-

end

|

|

@@ -1,15 +0,0 @@

|

|

|

1

|

-

# frozen_string_literal: true

|

|

2

|

-

|

|

3

|

-

require_relative '../../../parsing'

|

|

4

|

-

|

|

5

|

-

module Mindee

|

|

6

|

-

module Product

|

|

7

|

-

module US

|

|

8

|

-

module W9

|

|

9

|

-

# W9 API version 1.0 document data.

|

|

10

|

-

class W9V1Document < Mindee::Parsing::Common::Prediction

|

|

11

|

-

end

|

|

12

|

-

end

|

|

13

|

-

end

|

|

14

|

-

end

|

|

15

|

-

end

|

|

@@ -1,133 +0,0 @@

|

|

|

1

|

-

# frozen_string_literal: true

|

|

2

|

-

|

|

3

|

-

require_relative '../../../parsing'

|

|

4

|

-

require_relative 'w9_v1_document'

|

|

5

|

-

|

|

6

|

-

module Mindee

|

|

7

|

-

module Product

|

|

8

|

-

module US

|

|

9

|

-

module W9

|

|

10

|

-

# W9 API version 1.0 page data.

|

|

11

|

-

class W9V1Page < Mindee::Parsing::Common::Page

|

|

12

|

-

# @param prediction [Hash]

|

|

13

|

-

def initialize(prediction)

|

|

14

|

-

super

|

|

15

|

-

@prediction = if prediction['prediction'].empty?

|

|

16

|

-

nil

|

|

17

|

-

else

|

|

18

|

-

W9V1PagePrediction.new(

|

|

19

|

-

prediction['prediction'],

|

|

20

|

-

prediction['id']

|

|

21

|

-

)

|

|

22

|

-

end

|

|

23

|

-

end

|

|

24

|

-

end

|

|

25

|

-

|

|

26

|

-

# W9 V1 page prediction.

|

|

27

|

-

class W9V1PagePrediction < W9V1Document

|

|

28

|

-

include Mindee::Parsing::Standard

|

|

29

|

-

|

|

30

|

-

# The street address (number, street, and apt. or suite no.) of the applicant.

|

|

31

|

-

# @return [Mindee::Parsing::Standard::StringField]

|

|

32

|

-

attr_reader :address

|

|

33

|

-

# The business name or disregarded entity name, if different from Name.

|

|

34

|

-

# @return [Mindee::Parsing::Standard::StringField]

|

|

35

|

-

attr_reader :business_name

|

|

36

|

-

# The city, state, and ZIP code of the applicant.

|

|

37

|

-

# @return [Mindee::Parsing::Standard::StringField]

|

|

38

|

-

attr_reader :city_state_zip

|

|

39

|

-

# The employer identification number.

|

|

40

|

-

# @return [Mindee::Parsing::Standard::StringField]

|

|

41

|

-

attr_reader :ein

|

|

42

|

-

# Name as shown on the applicant's income tax return.

|

|

43

|

-

# @return [Mindee::Parsing::Standard::StringField]

|

|

44

|

-

attr_reader :name

|

|

45

|

-

# Position of the signature date on the document.

|

|

46

|

-

# @return [Mindee::Parsing::Standard::PositionField]

|

|

47

|

-

attr_reader :signature_date_position

|

|

48

|

-

# Position of the signature on the document.

|

|

49

|

-

# @return [Mindee::Parsing::Standard::PositionField]

|

|

50

|

-

attr_reader :signature_position

|

|

51

|

-

# The applicant's social security number.

|

|

52

|

-

# @return [Mindee::Parsing::Standard::StringField]

|

|

53

|

-

attr_reader :ssn

|

|

54

|

-

# The federal tax classification, which can vary depending on the revision date.

|

|

55

|

-

# @return [Mindee::Parsing::Standard::StringField]

|

|

56

|

-

attr_reader :tax_classification

|

|

57

|

-

# Depending on revision year, among S, C, P or D for Limited Liability Company Classification.

|

|

58

|

-

# @return [Mindee::Parsing::Standard::StringField]

|

|

59

|

-

attr_reader :tax_classification_llc

|

|

60

|

-

# Tax Classification Other Details.

|

|

61

|

-

# @return [Mindee::Parsing::Standard::StringField]

|

|

62

|

-

attr_reader :tax_classification_other_details

|

|

63

|

-

# The Revision month and year of the W9 form.

|

|

64

|

-

# @return [Mindee::Parsing::Standard::StringField]

|

|

65

|

-

attr_reader :w9_revision_date

|

|

66

|

-

|

|

67

|

-

# @param prediction [Hash]

|

|

68

|

-

# @param page_id [Integer, nil]

|

|

69

|

-

def initialize(prediction, page_id)

|

|

70

|

-

@address = Parsing::Standard::StringField.new(

|

|

71

|

-

prediction['address'],

|

|

72

|

-

page_id

|

|

73

|

-

)

|

|

74

|

-

@business_name = Parsing::Standard::StringField.new(

|

|

75

|

-

prediction['business_name'],

|

|

76

|

-

page_id

|

|

77

|

-

)

|

|

78

|

-

@city_state_zip = Parsing::Standard::StringField.new(

|

|

79

|

-

prediction['city_state_zip'],

|

|

80

|

-

page_id

|

|

81

|

-

)

|

|

82

|

-

@ein = Parsing::Standard::StringField.new(prediction['ein'], page_id)

|

|

83

|

-

@name = Parsing::Standard::StringField.new(prediction['name'], page_id)

|

|

84

|

-

@signature_date_position = Parsing::Standard::PositionField.new(

|

|

85

|

-

prediction['signature_date_position'],

|

|

86

|

-

page_id

|

|

87

|

-

)

|

|

88

|

-

@signature_position = Parsing::Standard::PositionField.new(

|

|

89

|

-

prediction['signature_position'],

|

|

90

|

-

page_id

|

|

91

|

-

)

|

|

92

|

-

@ssn = Parsing::Standard::StringField.new(prediction['ssn'], page_id)

|

|

93

|

-

@tax_classification = Parsing::Standard::StringField.new(

|

|

94

|

-

prediction['tax_classification'],

|

|

95

|

-

page_id

|

|

96

|

-

)

|

|

97

|

-

@tax_classification_llc = Parsing::Standard::StringField.new(

|

|

98

|

-

prediction['tax_classification_llc'],

|

|

99

|

-

page_id

|

|

100

|

-

)

|

|

101

|

-

@tax_classification_other_details = Parsing::Standard::StringField.new(

|

|

102

|

-

prediction['tax_classification_other_details'],

|

|

103

|

-

page_id

|

|

104

|

-

)

|

|

105

|

-

@w9_revision_date = Parsing::Standard::StringField.new(

|

|

106

|

-

prediction['w9_revision_date'],

|

|

107

|

-

page_id

|

|

108

|

-

)

|

|

109

|

-

super

|

|

110

|

-

end

|

|

111

|

-

|

|

112

|

-

# @return [String]

|

|

113

|

-

def to_s

|

|

114

|

-

out_str = String.new

|

|

115

|

-

out_str << "\n:Name: #{@name}".rstrip

|

|

116

|

-

out_str << "\n:SSN: #{@ssn}".rstrip

|

|

117

|

-

out_str << "\n:Address: #{@address}".rstrip

|

|

118

|

-

out_str << "\n:City State Zip: #{@city_state_zip}".rstrip

|

|

119

|

-

out_str << "\n:Business Name: #{@business_name}".rstrip

|

|

120

|

-

out_str << "\n:EIN: #{@ein}".rstrip

|

|

121

|

-

out_str << "\n:Tax Classification: #{@tax_classification}".rstrip

|

|

122

|

-

out_str << "\n:Tax Classification Other Details: #{@tax_classification_other_details}".rstrip

|

|

123

|

-

out_str << "\n:W9 Revision Date: #{@w9_revision_date}".rstrip

|

|

124

|

-

out_str << "\n:Signature Position: #{@signature_position}".rstrip

|

|

125

|

-

out_str << "\n:Signature Date Position: #{@signature_date_position}".rstrip

|

|

126

|

-

out_str << "\n:Tax Classification LLC: #{@tax_classification_llc}".rstrip

|

|

127

|

-

out_str

|

|

128

|

-

end

|

|

129

|

-

end

|

|

130

|

-

end

|

|

131

|

-

end

|

|

132

|

-

end

|

|

133

|

-

end

|