quantjourney-bidask 0.9.4__tar.gz → 1.0.1__tar.gz

This diff represents the content of publicly available package versions that have been released to one of the supported registries. The information contained in this diff is provided for informational purposes only and reflects changes between package versions as they appear in their respective public registries.

- {quantjourney_bidask-0.9.4 → quantjourney_bidask-1.0.1}/PKG-INFO +94 -35

- {quantjourney_bidask-0.9.4 → quantjourney_bidask-1.0.1}/README.md +90 -33

- quantjourney_bidask-1.0.1/data/fetch.py +399 -0

- quantjourney_bidask-1.0.1/examples/animated_spread_monitor.py +528 -0

- quantjourney_bidask-1.0.1/examples/basic_spread_estimation.py +193 -0

- {quantjourney_bidask-0.9.4 → quantjourney_bidask-1.0.1}/examples/crypto_spread_comparison.py +256 -193

- quantjourney_bidask-1.0.1/examples/liquidity_risk_monitor.py +105 -0

- {quantjourney_bidask-0.9.4 → quantjourney_bidask-1.0.1}/examples/simple_data_example.py +81 -46

- quantjourney_bidask-1.0.1/examples/threshold_alert_monitor.py +269 -0

- quantjourney_bidask-0.9.4/examples/realtime_spread_monitor.py → quantjourney_bidask-1.0.1/examples/websocket_realtime_demo.py +292 -188

- {quantjourney_bidask-0.9.4 → quantjourney_bidask-1.0.1}/pyproject.toml +6 -4

- quantjourney_bidask-1.0.1/quantjourney_bidask/__init__.py +34 -0

- quantjourney_bidask-1.0.1/quantjourney_bidask/_compare_edge.py +152 -0

- quantjourney_bidask-1.0.1/quantjourney_bidask/edge.py +174 -0

- quantjourney_bidask-1.0.1/quantjourney_bidask/edge_expanding.py +53 -0

- quantjourney_bidask-1.0.1/quantjourney_bidask/edge_hft.py +126 -0

- quantjourney_bidask-1.0.1/quantjourney_bidask/edge_rolling.py +64 -0

- {quantjourney_bidask-0.9.4 → quantjourney_bidask-1.0.1}/quantjourney_bidask.egg-info/SOURCES.txt +6 -8

- {quantjourney_bidask-0.9.4 → quantjourney_bidask-1.0.1}/requirements.txt +1 -0

- quantjourney_bidask-0.9.4/data/fetch.py +0 -258

- quantjourney_bidask-0.9.4/examples/animated_spread_monitor.py +0 -301

- quantjourney_bidask-0.9.4/examples/liquidity_risk_monitor.py +0 -72

- quantjourney_bidask-0.9.4/examples/spread_estimator.py +0 -153

- quantjourney_bidask-0.9.4/examples/spread_monitor.py +0 -208

- quantjourney_bidask-0.9.4/examples/stock_liquidity_risk.py +0 -47

- quantjourney_bidask-0.9.4/examples/visualization.py +0 -142

- quantjourney_bidask-0.9.4/quantjourney_bidask/__init__.py +0 -7

- quantjourney_bidask-0.9.4/quantjourney_bidask/_version.py +0 -7

- quantjourney_bidask-0.9.4/quantjourney_bidask/edge.py +0 -152

- quantjourney_bidask-0.9.4/quantjourney_bidask/edge_expanding.py +0 -65

- quantjourney_bidask-0.9.4/quantjourney_bidask/edge_rolling.py +0 -208

- quantjourney_bidask-0.9.4/quantjourney_bidask/websocket_fetcher.py +0 -308

- {quantjourney_bidask-0.9.4 → quantjourney_bidask-1.0.1}/CHANGELOG.md +0 -0

- {quantjourney_bidask-0.9.4 → quantjourney_bidask-1.0.1}/LICENSE +0 -0

- {quantjourney_bidask-0.9.4 → quantjourney_bidask-1.0.1}/MANIFEST.in +0 -0

- {quantjourney_bidask-0.9.4 → quantjourney_bidask-1.0.1}/docs/usage_examples.ipynb +0 -0

- {quantjourney_bidask-0.9.4 → quantjourney_bidask-1.0.1}/setup.cfg +0 -0

|

@@ -1,9 +1,9 @@

|

|

|

1

1

|

Metadata-Version: 2.4

|

|

2

2

|

Name: quantjourney-bidask

|

|

3

|

-

Version: 0.

|

|

3

|

+

Version: 1.0.1

|

|

4

4

|

Summary: Efficient bid-ask spread estimator from OHLC prices

|

|

5

5

|

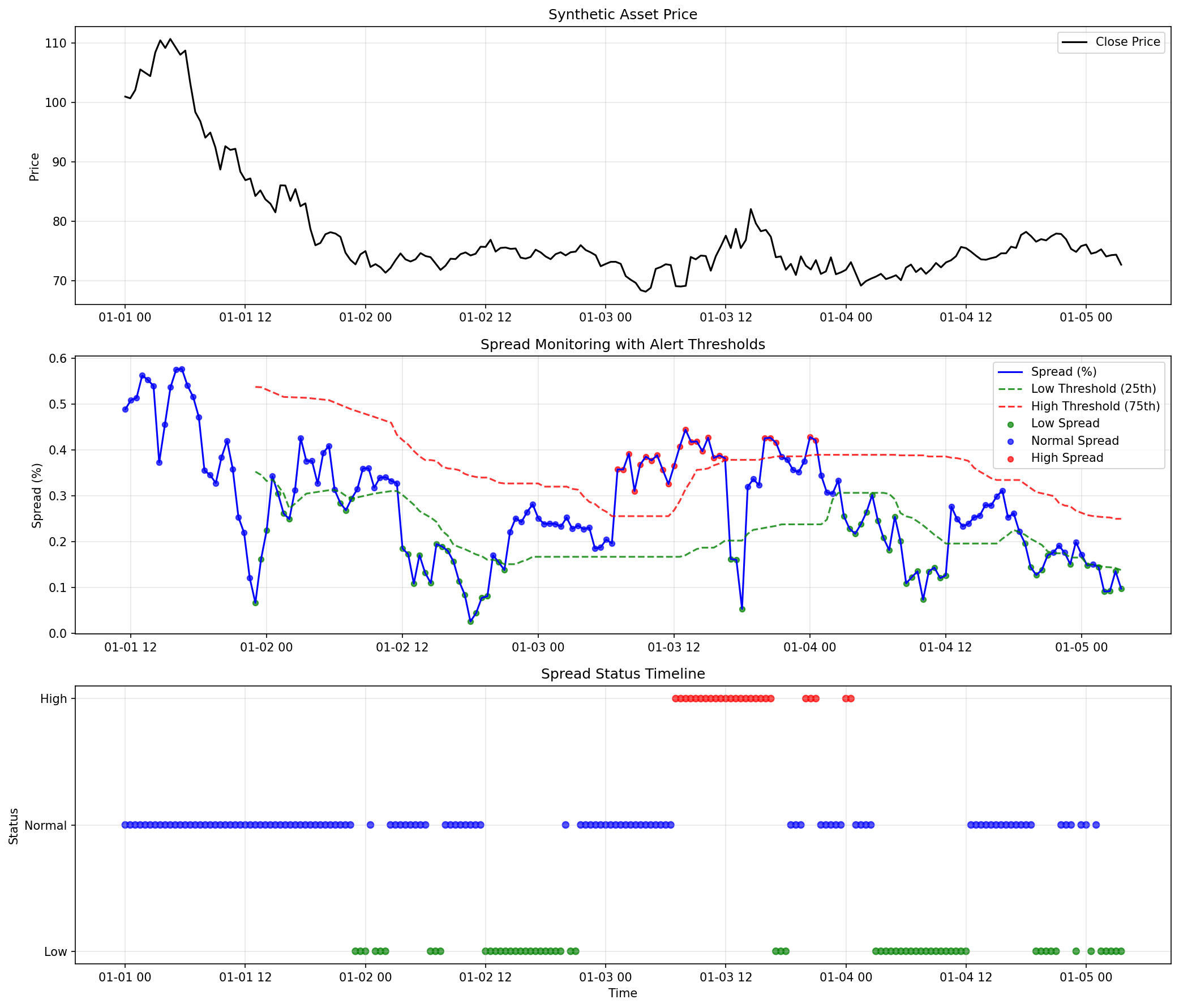

Author-email: Jakub Polec <jakub@quantjourney.pro>

|

|

6

|

-

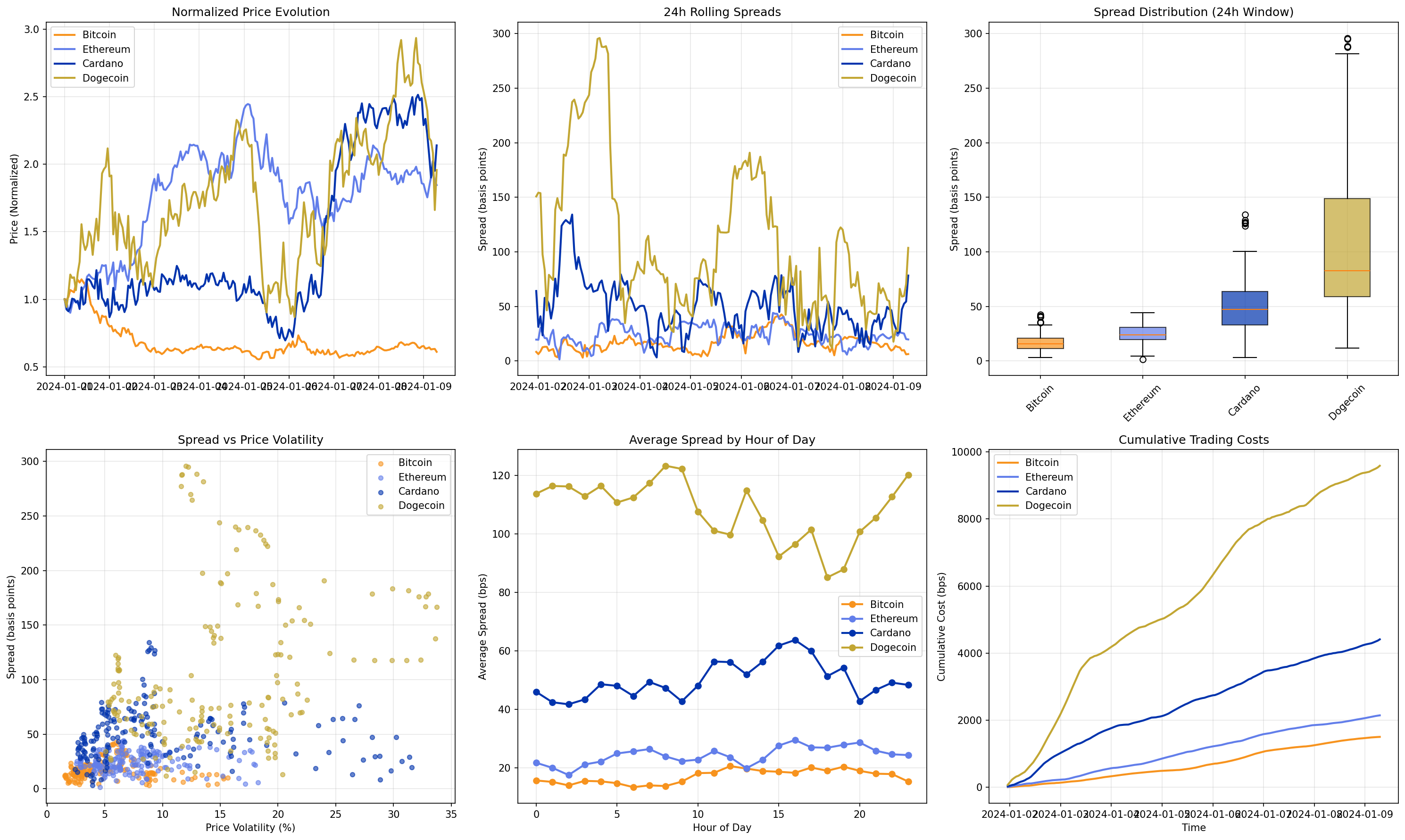

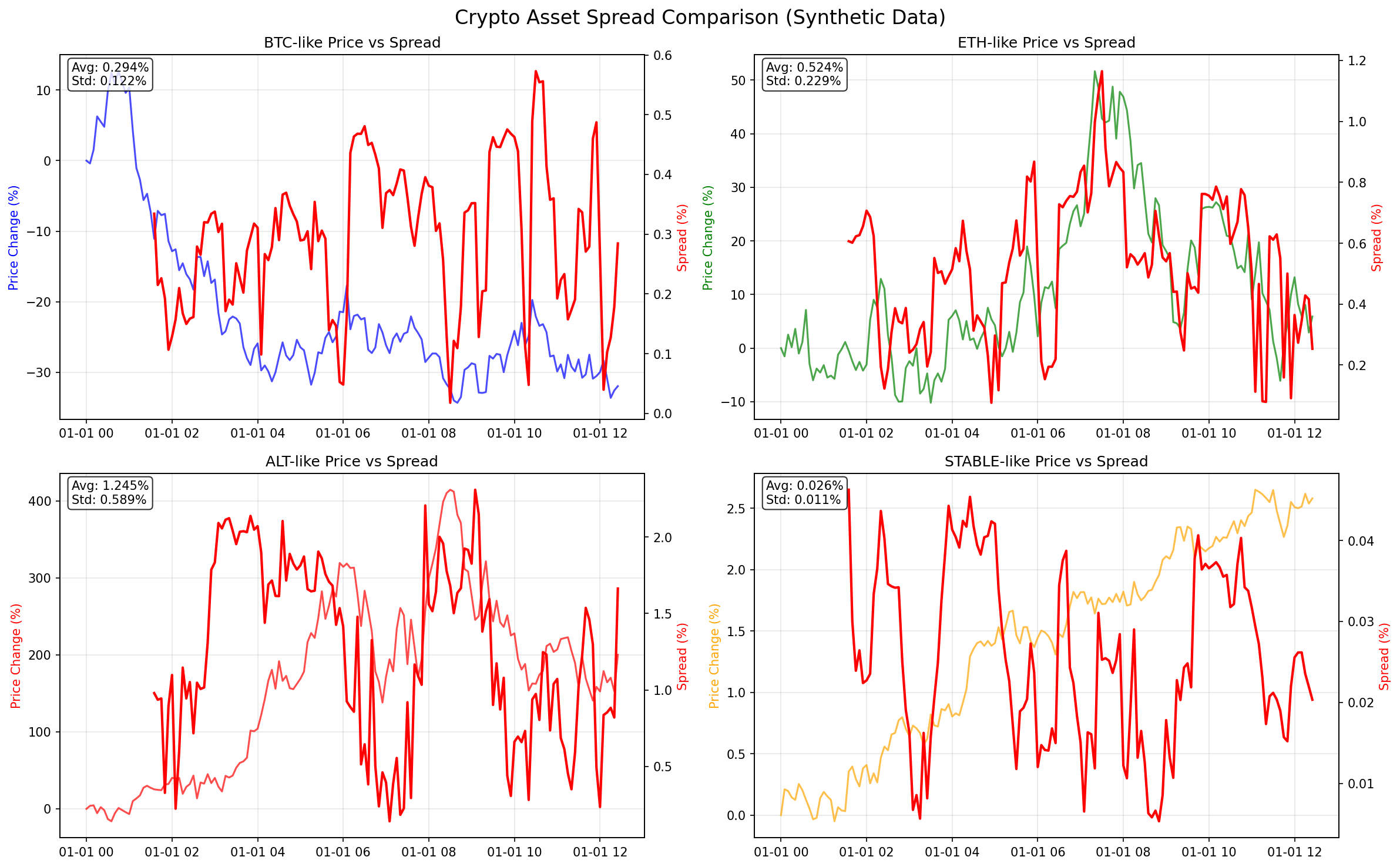

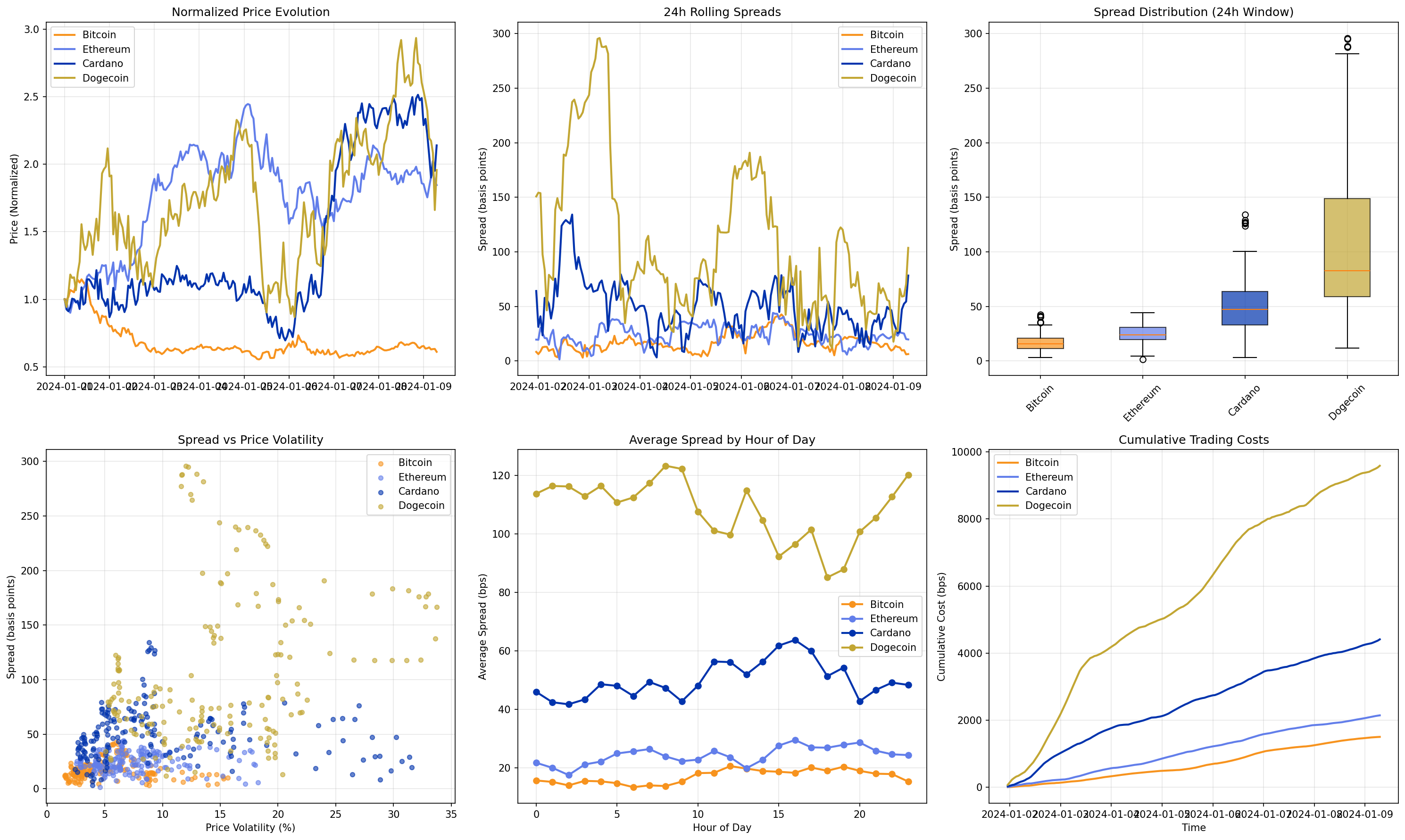

License

|

|

6

|

+

License: MIT

|

|

7

7

|

Project-URL: Homepage, https://github.com/QuantJourneyOrg/qj_bidask

|

|

8

8

|

Project-URL: Repository, https://github.com/QuantJourneyOrg/qj_bidask

|

|

9

9

|

Project-URL: Bug Tracker, https://github.com/QuantJourneyOrg/qj_bidask/issues

|

|

@@ -26,6 +26,7 @@ Requires-Dist: yfinance>=0.2

|

|

|

26

26

|

Requires-Dist: matplotlib>=3.5

|

|

27

27

|

Requires-Dist: plotly>=5.0

|

|

28

28

|

Requires-Dist: websocket-client>=1.0

|

|

29

|

+

Requires-Dist: numba

|

|

29

30

|

Provides-Extra: dev

|

|

30

31

|

Requires-Dist: pytest>=7.0; extra == "dev"

|

|

31

32

|

Requires-Dist: pytest-mock>=3.10; extra == "dev"

|

|

@@ -34,6 +35,7 @@ Requires-Dist: ruff>=0.1; extra == "dev"

|

|

|

34

35

|

Requires-Dist: mypy>=1.0; extra == "dev"

|

|

35

36

|

Requires-Dist: black>=22.0; extra == "dev"

|

|

36

37

|

Requires-Dist: isort>=5.0; extra == "dev"

|

|

38

|

+

Requires-Dist: numba; extra == "dev"

|

|

37

39

|

Provides-Extra: examples

|

|

38

40

|

Requires-Dist: jupyter>=1.0; extra == "examples"

|

|

39

41

|

Requires-Dist: ipywidgets>=7.0; extra == "examples"

|

|

@@ -41,9 +43,13 @@ Dynamic: license-file

|

|

|

41

43

|

|

|

42

44

|

# QuantJourney Bid-Ask Spread Estimator

|

|

43

45

|

|

|

44

|

-

|

|

47

|

+

[](https://pypi.org/project/quantjourney-bidask/)

|

|

48

|

+

[](https://pypi.org/project/quantjourney-bidask/)

|

|

49

|

+

[](https://pepy.tech/project/quantjourney-bidask)

|

|

50

|

+

[](https://github.com/QuantJourneyOrg/qj_bidask/blob/main/LICENSE)

|

|

51

|

+

[](https://github.com/QuantJourneyOrg/qj_bidask)

|

|

52

|

+

|

|

47

53

|

|

|

48

54

|

The `quantjourney-bidask` library provides an efficient estimator for calculating bid-ask spreads from open, high, low, and close (OHLC) prices, based on the methodology described in:

|

|

49

55

|

|

|

@@ -51,6 +57,8 @@ The `quantjourney-bidask` library provides an efficient estimator for calculatin

|

|

|

51

57

|

|

|

52

58

|

This library is designed for quantitative finance professionals, researchers, and traders who need accurate and computationally efficient spread estimates for equities, cryptocurrencies, and other assets.

|

|

53

59

|

|

|

60

|

+

🚀 **Part of the [QuantJourney](https://quantjourney.substack.com/) ecosystem** - The framework with advanced quantitative finance tools and insights!

|

|

61

|

+

|

|

54

62

|

## Features

|

|

55

63

|

|

|

56

64

|

- **Efficient Spread Estimation**: Implements the EDGE estimator for single, rolling, and expanding windows.

|

|

@@ -62,6 +70,61 @@ This library is designed for quantitative finance professionals, researchers, an

|

|

|

62

70

|

- **Comprehensive Tests**: Extensive unit tests with known test cases from the original paper.

|

|

63

71

|

- **Clear Documentation**: Detailed docstrings and usage examples.

|

|

64

72

|

|

|

73

|

+

## Examples and Visualizations

|

|

74

|

+

|

|

75

|

+

The package includes comprehensive examples with beautiful visualizations:

|

|

76

|

+

|

|

77

|

+

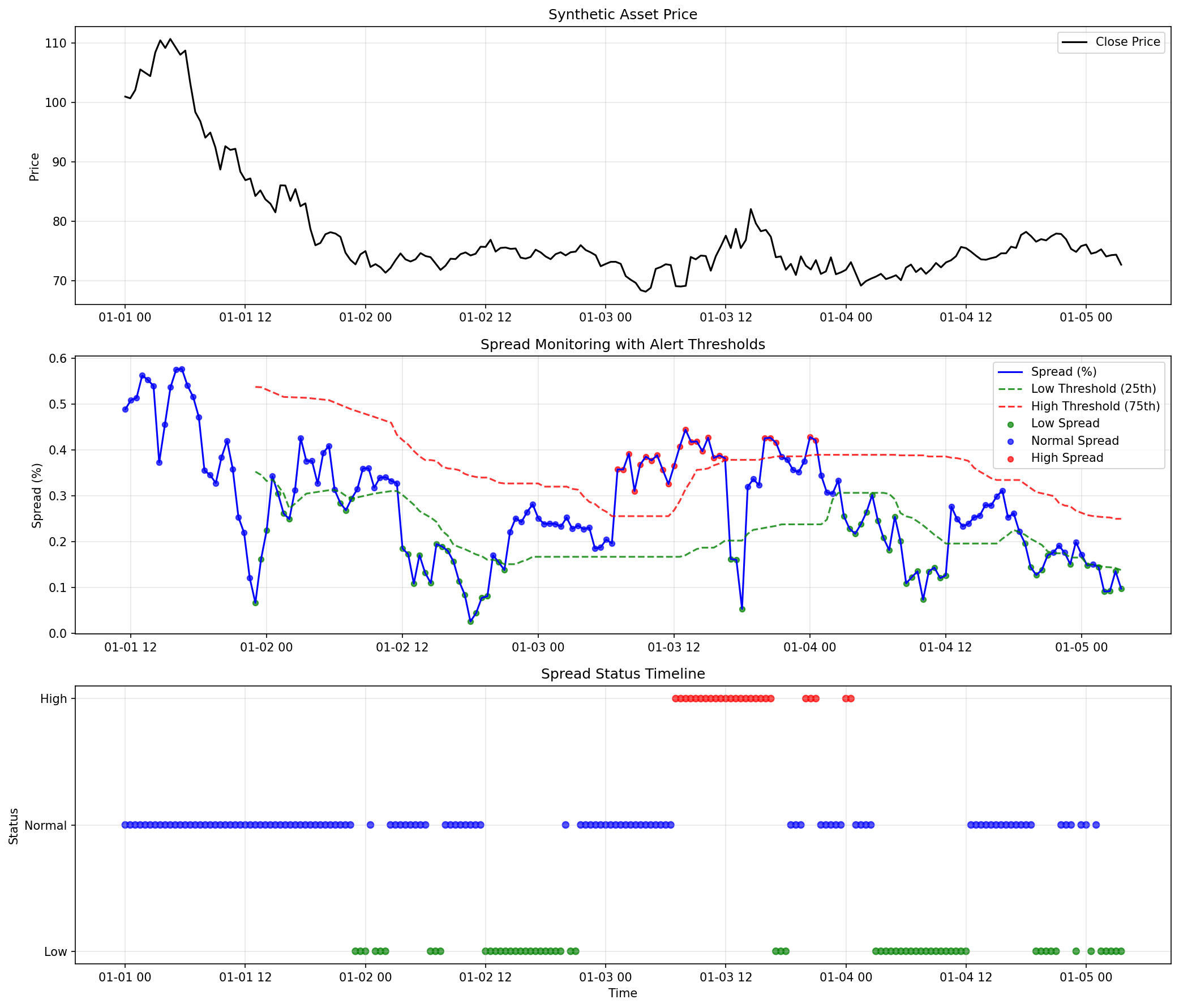

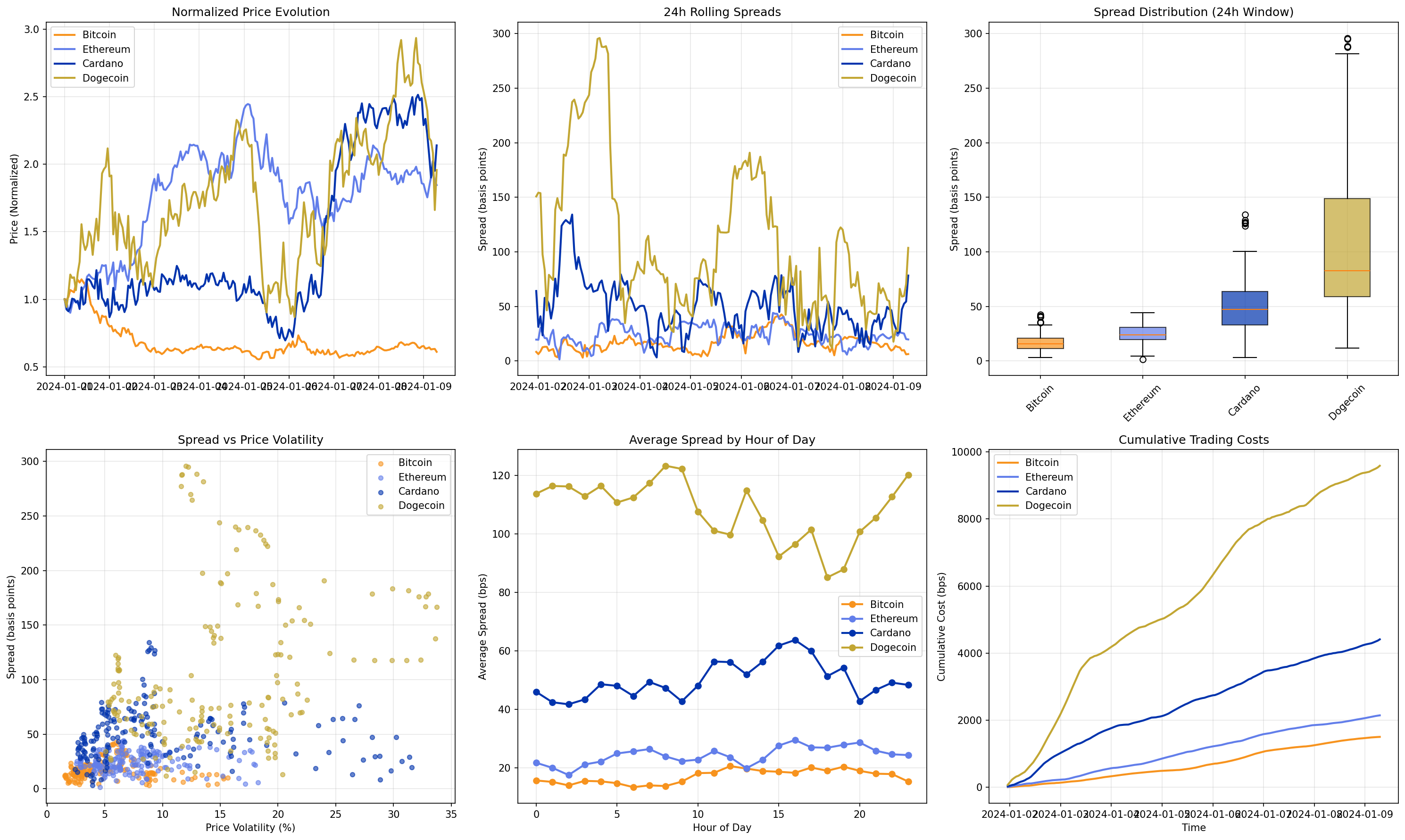

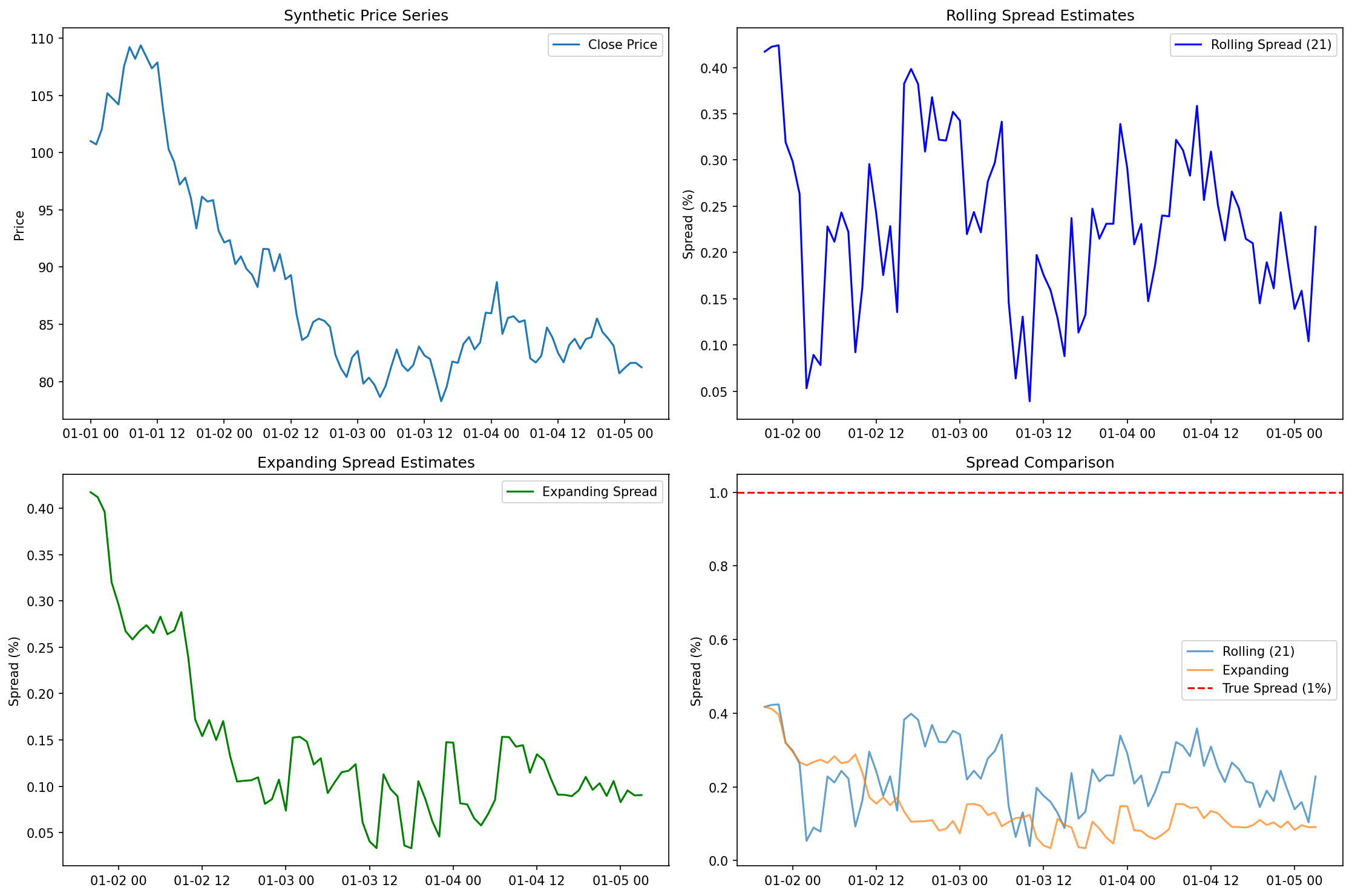

### Spread Monitor Results

|

|

78

|

+

|

|

79

|

+

|

|

80

|

+

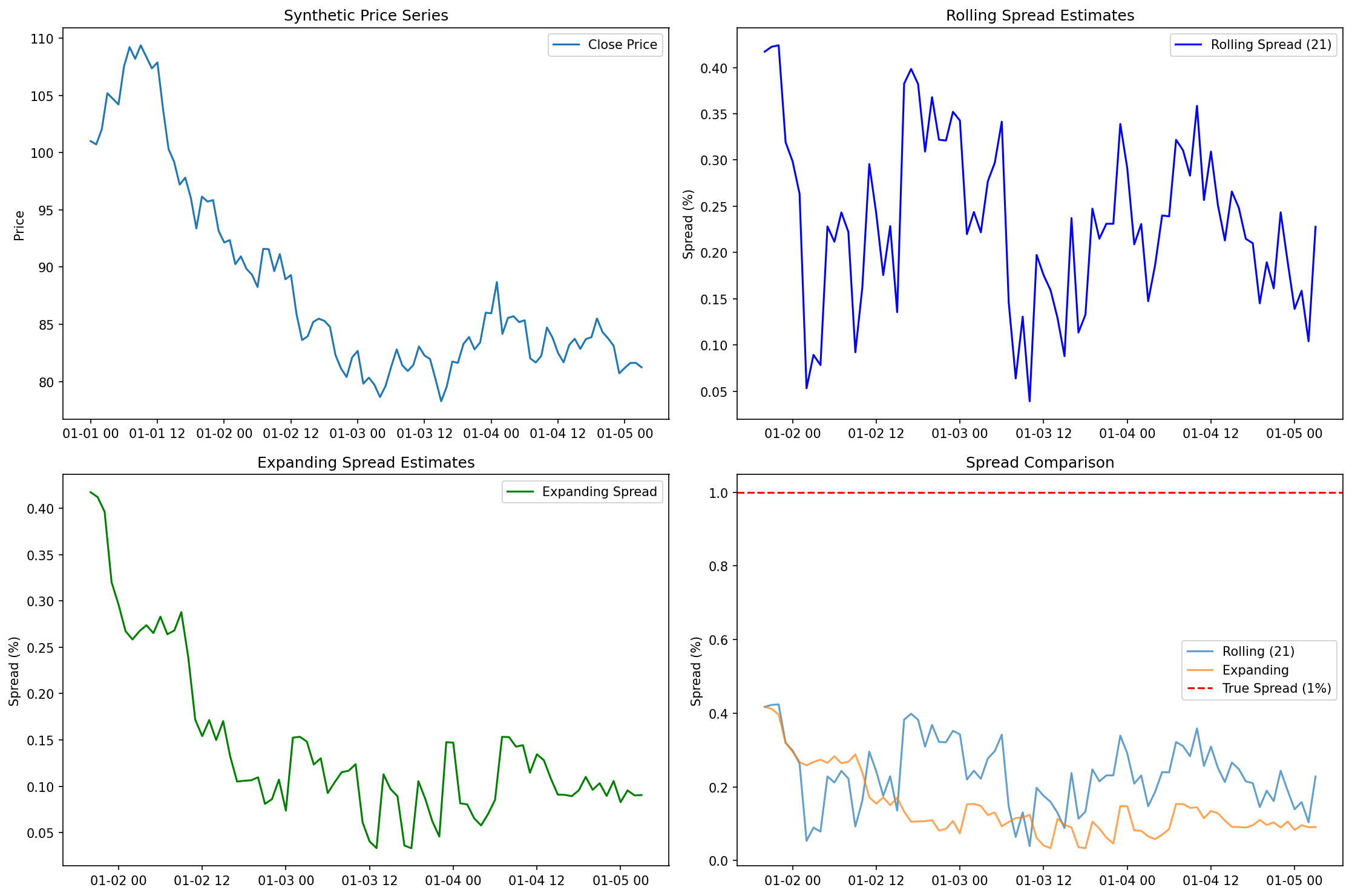

### Basic Data Analysis

|

|

81

|

+

|

|

82

|

+

|

|

83

|

+

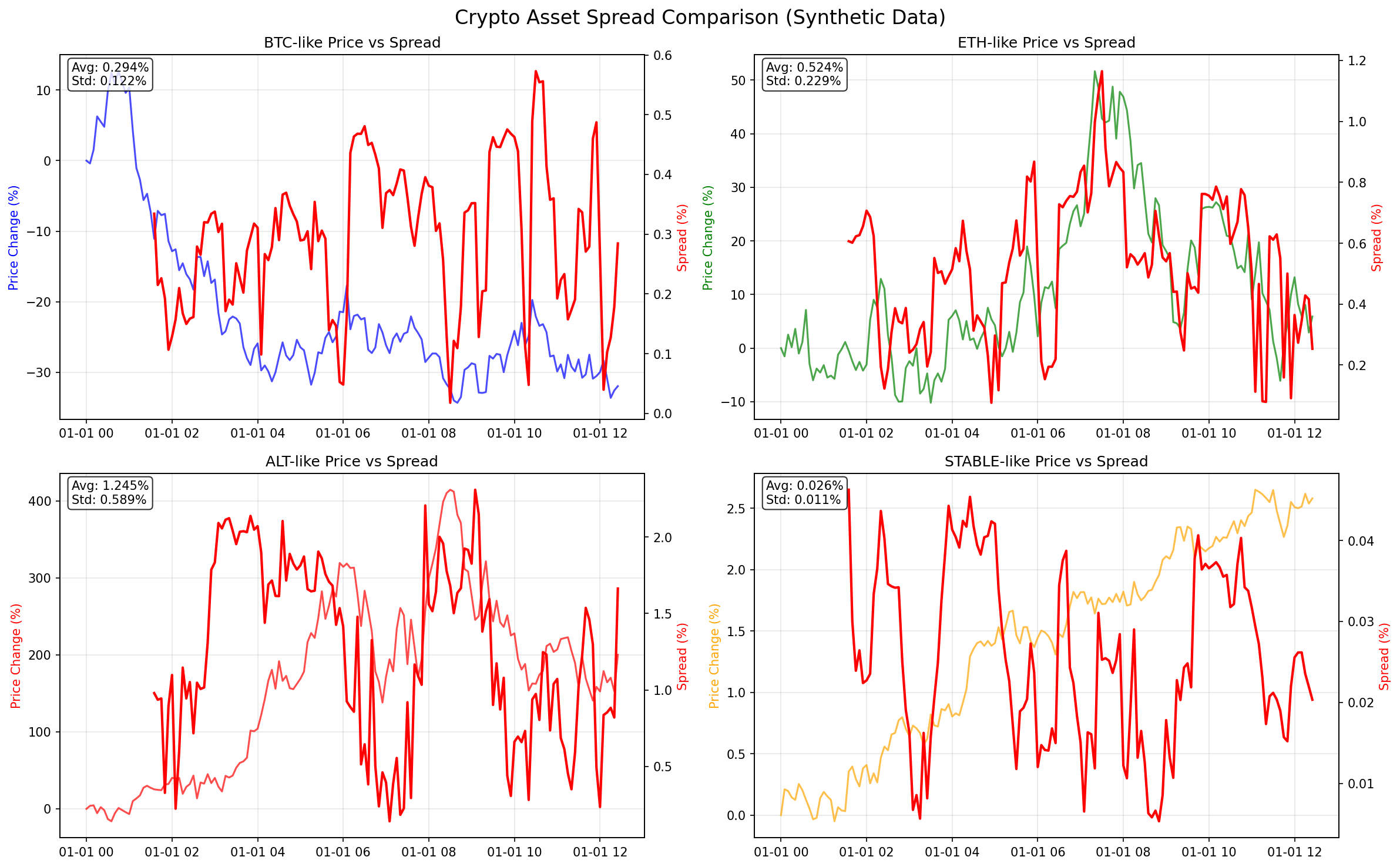

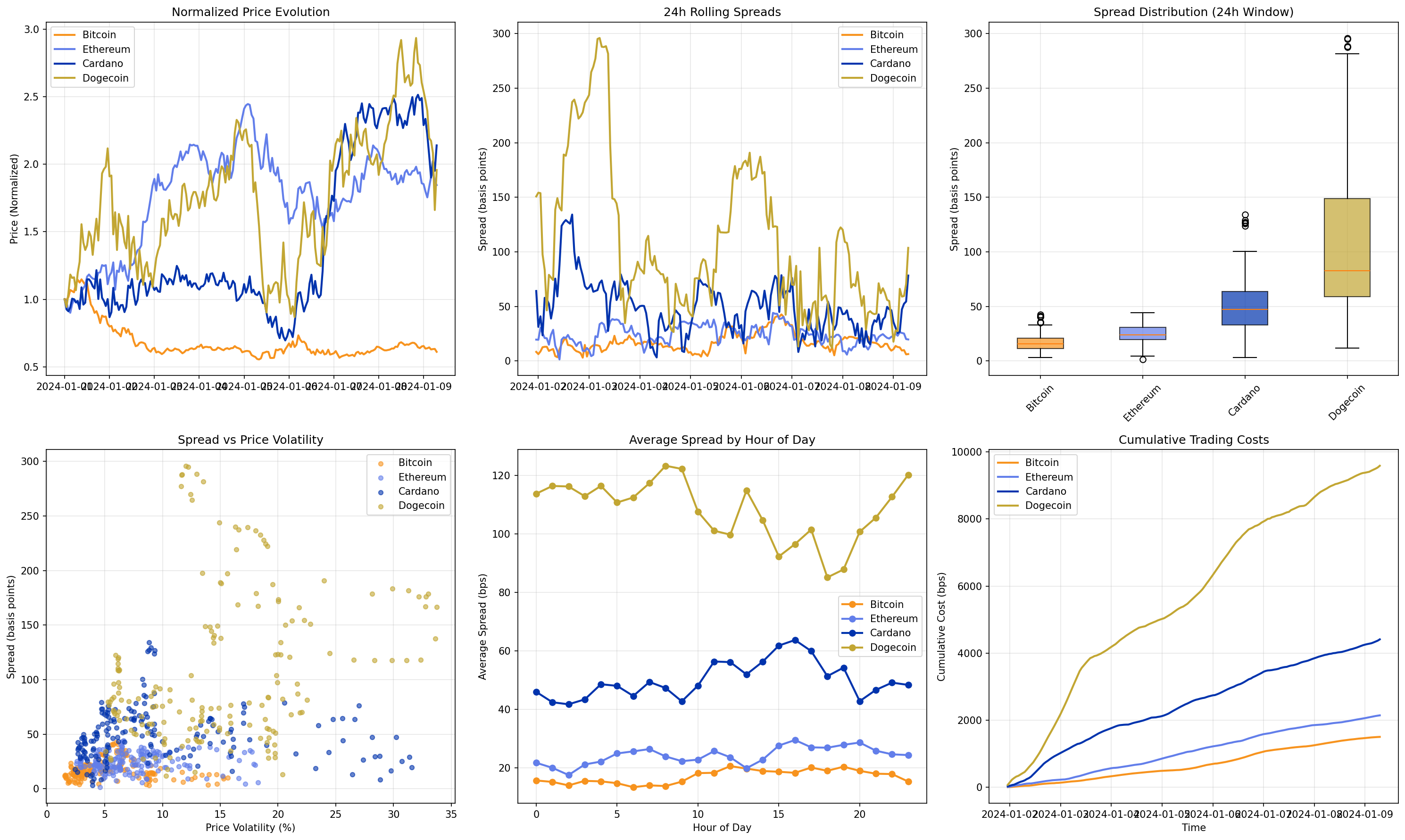

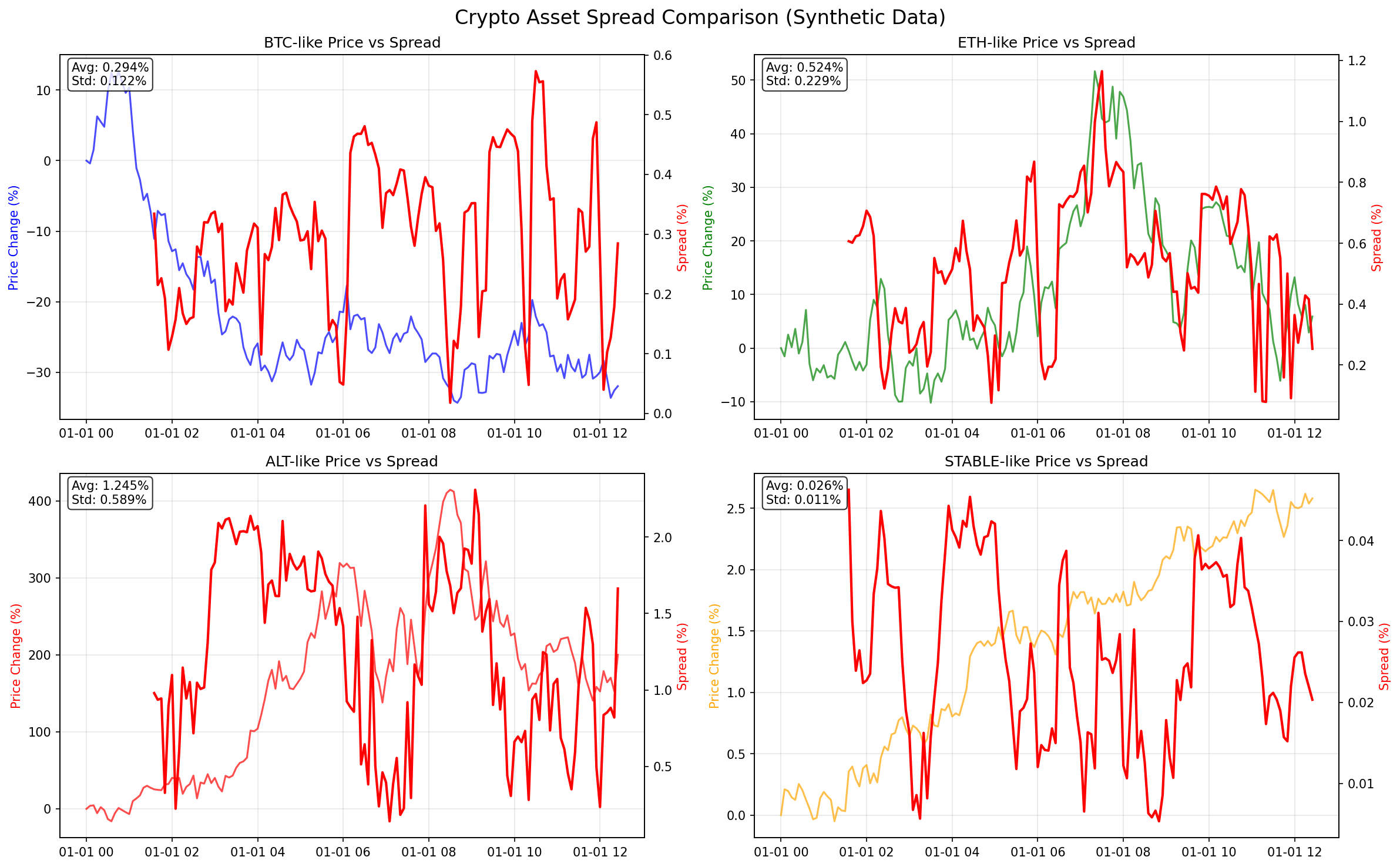

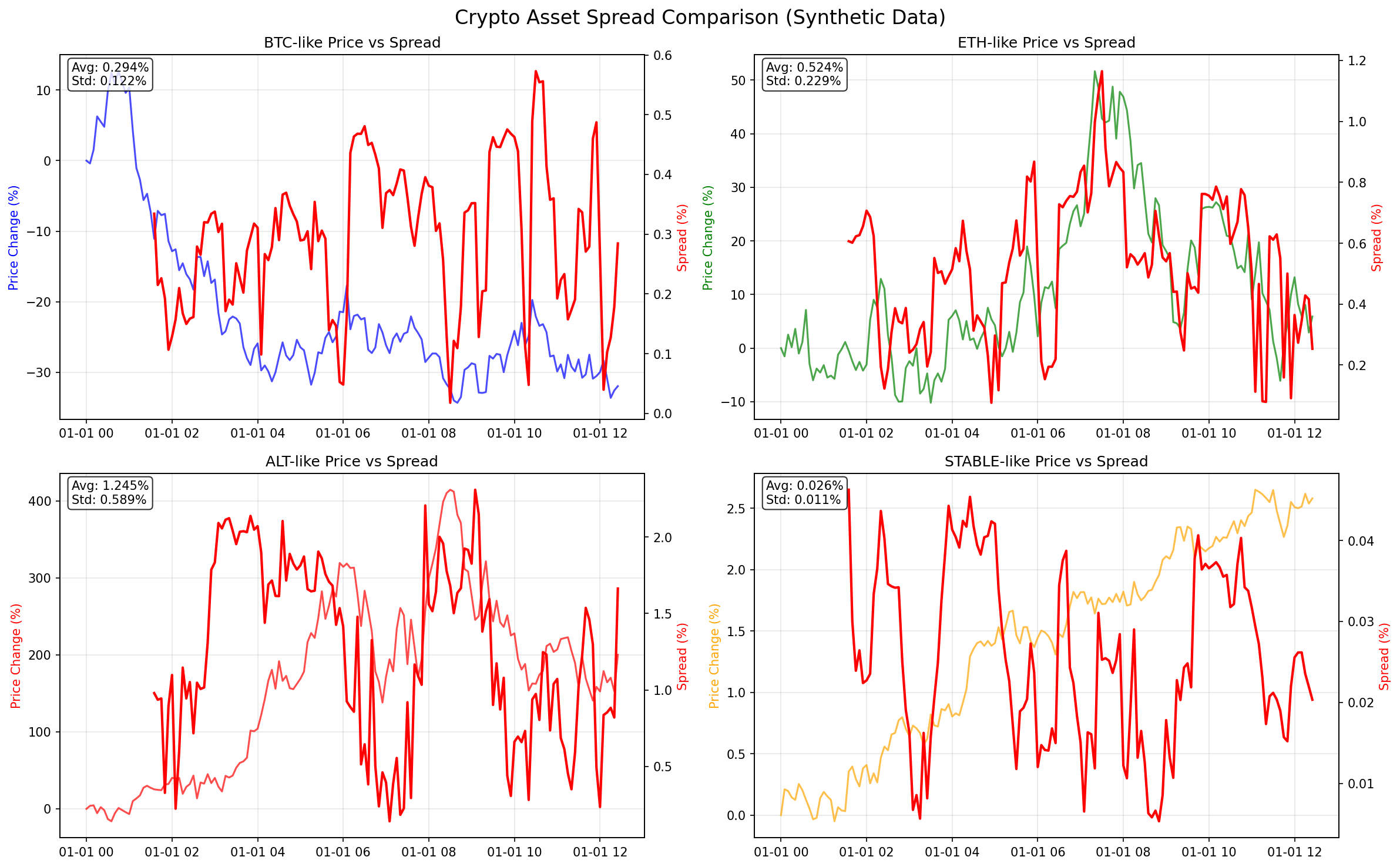

### Crypto Spread Comparison

|

|

84

|

+

|

|

85

|

+

|

|

86

|

+

## FAQ

|

|

87

|

+

|

|

88

|

+

### What exactly does the estimator compute?

|

|

89

|

+

The estimator returns the root mean square effective spread over the sample period. This quantifies the average transaction cost implied by bid-ask spreads, based on open, high, low, and close (OHLC) prices.

|

|

90

|

+

|

|

91

|

+

### What is unique about this implementation?

|

|

92

|

+

This package provides a highly optimized and robust implementation of the EDGE estimator. Beyond a direct translation of the paper's formula, it features:

|

|

93

|

+

|

|

94

|

+

- A Hybrid, High-Performance Engine: The core logic leverages fast, vectorized NumPy operations for data preparation and calls a specialized, JIT-compiled kernel via Numba for the computationally intensive GMM calculations.

|

|

95

|

+

- HFT-Ready Version (edge_hft.py): An included, hyper-optimized function that uses fastmath compilation for the absolute lowest latency, designed for production HFT pipelines where every microsecond matters.

|

|

96

|

+

- Robust Data Handling: Gracefully manages missing values (NaN) and non-positive prices to prevent crashes.

|

|

97

|

+

- Advanced Windowing Functions: Efficient and correct edge_rolling and edge_expanding functions that are fully compatible with the powerful features of pandas, including custom step sizes.

|

|

98

|

+

|

|

99

|

+

### What's the difference between the edge functions?

|

|

100

|

+

The library provides a tiered set of functions for different needs:

|

|

101

|

+

|

|

102

|

+

- edge(): The core function. It's fast, robust, and computes a single spread estimate for a given sample of data. This is the building block for all other functions.

|

|

103

|

+

- edge_hft(): A specialized version of edge() for HFT users. It's the fastest possible implementation but requires perfectly clean input data (no NaNs) to achieve its speed.

|

|

104

|

+

- edge_rolling(): Computes the spread on a rolling window over a time series. It's perfect for seeing how the spread evolves over time. It is highly optimized and accepts all arguments from pandas.DataFrame.rolling() (like window and step).

|

|

105

|

+

- edge_expanding(): Computes the spread on an expanding (cumulative) window. This is useful for analyzing how the spread estimate converges or changes as more data becomes available.

|

|

106

|

+

|

|

107

|

+

### What is the minimum number of observations?

|

|

108

|

+

At least 3 valid observations are required.

|

|

109

|

+

|

|

110

|

+

### How should I choose the window size or frequency?

|

|

111

|

+

Short windows (e.g. a few days) reflect local spread conditions but may be noisy. Longer windows (e.g. 1 year) reduce variance but smooth over changes. For intraday use, minute-level frequency is recommended if the asset trades frequently.

|

|

112

|

+

|

|

113

|

+

Rule of thumb: ensure on average ≥2 trades per interval.

|

|

114

|

+

|

|

115

|

+

### Can I use intraday or tick data?

|

|

116

|

+

Yes — the estimator supports intraday OHLC data directly. For tick data, resample into OHLC format first (e.g., using pandas.resample).

|

|

117

|

+

|

|

118

|

+

### What if I get NaN results?

|

|

119

|

+

The estimator may return NaN if:

|

|

120

|

+

|

|

121

|

+

- Input prices are inconsistent (e.g. high < low)

|

|

122

|

+

- There are too many missing or invalid values

|

|

123

|

+

- Probability thresholds are not met (e.g. insufficient variance in prices)

|

|

124

|

+

- Spread variance is non-positive

|

|

125

|

+

|

|

126

|

+

In these cases, re-examine your input or adjust the sampling frequency.

|

|

127

|

+

|

|

65

128

|

## Installation

|

|

66

129

|

|

|

67

130

|

Install the library via pip:

|

|

@@ -123,9 +186,9 @@ from quantjourney_bidask import edge_rolling

|

|

|

123

186

|

import asyncio

|

|

124

187

|

|

|

125

188

|

# Fetch stock data

|

|

126

|

-

stock_df = get_stock_data("

|

|

189

|

+

stock_df = get_stock_data("PL", period="1mo", interval="1d")

|

|

127

190

|

stock_spreads = edge_rolling(stock_df, window=20)

|

|

128

|

-

print(f"

|

|

191

|

+

print(f"PL average spread: {stock_spreads.mean():.6f}")

|

|

129

192

|

|

|

130

193

|

# Fetch crypto data (async)

|

|

131

194

|

async def get_crypto_spreads():

|

|

@@ -178,10 +241,13 @@ monitor.start_monitoring("1m")

|

|

|

178

241

|

|

|

179

242

|

```python

|

|

180

243

|

# Run the real-time dashboard

|

|

181

|

-

python examples/

|

|

244

|

+

python examples/websocket_realtime_demo.py --mode dashboard

|

|

245

|

+

|

|

246

|

+

# Or console mode

|

|

247

|

+

python examples/websocket_realtime_demo.py --mode console

|

|

182

248

|

|

|

183

|

-

#

|

|

184

|

-

python examples/

|

|

249

|

+

# Quick 30-second BTC websocket demo

|

|

250

|

+

python examples/animated_spread_monitor.py

|

|

185

251

|

```

|

|

186

252

|

|

|

187

253

|

## Project Structure

|

|

@@ -190,42 +256,32 @@ python examples/realtime_spread_monitor.py --mode console

|

|

|

190

256

|

quantjourney_bidask/

|

|

191

257

|

├── quantjourney_bidask/ # Main library code

|

|

192

258

|

│ ├── __init__.py

|

|

193

|

-

│ ├── edge.py # Core EDGE estimator

|

|

259

|

+

│ ├── edge.py # Core EDGE estimator

|

|

260

|

+

│ ├── edge_hft.py # EDGE estimator optimised HFT-version

|

|

194

261

|

│ ├── edge_rolling.py # Rolling window estimation

|

|

195

262

|

│ └── edge_expanding.py # Expanding window estimation

|

|

196

263

|

├── data/

|

|

197

264

|

│ └── fetch.py # Simplified data fetcher for examples

|

|

198

265

|

├── examples/ # Comprehensive usage examples

|

|

199

266

|

│ ├── simple_data_example.py # Basic usage demonstration

|

|

200

|

-

│ ├──

|

|

267

|

+

│ ├── basic_spread_estimation.py # Core spread estimation examples

|

|

201

268

|

│ ├── animated_spread_monitor.py # Animated visualizations

|

|

202

269

|

│ ├── crypto_spread_comparison.py # Crypto spread analysis

|

|

203

270

|

│ ├── liquidity_risk_monitor.py # Risk monitoring

|

|

204

|

-

│ ├──

|

|

205

|

-

│ └──

|

|

271

|

+

│ ├── websocket_realtime_demo.py # Live websocket monitoring demo

|

|

272

|

+

│ └── threshold_alert_monitor.py # Threshold-based spread alerts

|

|

206

273

|

├── tests/ # Unit tests (GitHub only)

|

|

207

274

|

│ ├── test_edge.py

|

|

208

275

|

│ ├── test_edge_rolling.py

|

|

276

|

+

│ └── test_edge_expanding.py

|

|

209

277

|

│ └── test_data_fetcher.py

|

|

278

|

+

│ └── test_estimators.py

|

|

210

279

|

└── _output/ # Example output images

|

|

211

280

|

├── simple_data_example.png

|

|

212

281

|

├── crypto_spread_comparison.png

|

|

213

282

|

└── spread_estimator_results.png

|

|

214

283

|

```

|

|

215

284

|

|

|

216

|

-

## Examples and Visualizations

|

|

217

|

-

|

|

218

|

-

The package includes comprehensive examples with beautiful visualizations:

|

|

219

|

-

|

|

220

|

-

### Basic Data Analysis

|

|

221

|

-

|

|

222

|

-

|

|

223

|

-

### Crypto Spread Comparison

|

|

224

|

-

|

|

225

|

-

|

|

226

|

-

### Spread Estimation Results

|

|

227

|

-

|

|

228

|

-

|

|

229

285

|

### Running Examples

|

|

230

286

|

|

|

231

287

|

After installing via pip, examples are included in the package:

|

|

@@ -250,19 +306,20 @@ Or clone the repository for full access to examples and tests:

|

|

|

250

306

|

git clone https://github.com/QuantJourneyOrg/qj_bidask

|

|

251

307

|

cd qj_bidask

|

|

252

308

|

python examples/simple_data_example.py

|

|

253

|

-

python examples/

|

|

309

|

+

python examples/basic_spread_estimation.py

|

|

310

|

+

python examples/animated_spread_monitor.py # 30s real BTC websocket demo

|

|

254

311

|

python examples/crypto_spread_comparison.py

|

|

255

312

|

```

|

|

256

313

|

|

|

257

314

|

### Available Examples

|

|

258

315

|

|

|

259

316

|

- **`simple_data_example.py`** - Basic usage with stock and crypto data

|

|

260

|

-

- **`

|

|

261

|

-

- **`animated_spread_monitor.py`** - Real-time animated visualizations

|

|

262

|

-

- **`crypto_spread_comparison.py`** - Multi-asset crypto analysis

|

|

317

|

+

- **`basic_spread_estimation.py`** - Core spread estimation functionality

|

|

318

|

+

- **`animated_spread_monitor.py`** - Real-time animated visualizations with 30s websocket demo

|

|

319

|

+

- **`crypto_spread_comparison.py`** - Multi-asset crypto analysis and comparison

|

|

263

320

|

- **`liquidity_risk_monitor.py`** - Risk monitoring and alerts

|

|

264

|

-

- **`

|

|

265

|

-

- **`

|

|

321

|

+

- **`websocket_realtime_demo.py`** - Live websocket monitoring dashboard

|

|

322

|

+

- **`threshold_alert_monitor.py`** - Threshold-based spread alerts and monitoring

|

|

266

323

|

|

|

267

324

|

## Testing and Development

|

|

268

325

|

|

|

@@ -297,7 +354,8 @@ python -m pytest tests/test_data_fetcher.py -v

|

|

|

297

354

|

|

|

298

355

|

# Run examples

|

|

299

356

|

python examples/simple_data_example.py

|

|

300

|

-

python examples/

|

|

357

|

+

python examples/basic_spread_estimation.py

|

|

358

|

+

python examples/animated_spread_monitor.py # Real BTC websocket demo

|

|

301

359

|

```

|

|

302

360

|

|

|

303

361

|

### Package vs Repository

|

|

@@ -370,7 +428,8 @@ pip install -e ".[dev]"

|

|

|

370

428

|

pytest

|

|

371

429

|

|

|

372

430

|

# Run examples

|

|

373

|

-

python examples/

|

|

431

|

+

python examples/animated_spread_monitor.py # 30s real BTC websocket demo

|

|

432

|

+

python examples/websocket_realtime_demo.py # Full dashboard

|

|

374

433

|

```

|

|

375

434

|

|

|

376

435

|

## Support

|

|

@@ -1,8 +1,12 @@

|

|

|

1

1

|

# QuantJourney Bid-Ask Spread Estimator

|

|

2

2

|

|

|

3

|

-

|

|

4

|

+

[](https://pypi.org/project/quantjourney-bidask/)

|

|

5

|

+

[](https://pypi.org/project/quantjourney-bidask/)

|

|

6

|

+

[](https://pepy.tech/project/quantjourney-bidask)

|

|

7

|

+

[](https://github.com/QuantJourneyOrg/qj_bidask/blob/main/LICENSE)

|

|

8

|

+

[](https://github.com/QuantJourneyOrg/qj_bidask)

|

|

9

|

+

|

|

6

10

|

|

|

7

11

|

The `quantjourney-bidask` library provides an efficient estimator for calculating bid-ask spreads from open, high, low, and close (OHLC) prices, based on the methodology described in:

|

|

8

12

|

|

|

@@ -10,6 +14,8 @@ The `quantjourney-bidask` library provides an efficient estimator for calculatin

|

|

|

10

14

|

|

|

11

15

|

This library is designed for quantitative finance professionals, researchers, and traders who need accurate and computationally efficient spread estimates for equities, cryptocurrencies, and other assets.

|

|

12

16

|

|

|

17

|

+

🚀 **Part of the [QuantJourney](https://quantjourney.substack.com/) ecosystem** - The framework with advanced quantitative finance tools and insights!

|

|

18

|

+

|

|

13

19

|

## Features

|

|

14

20

|

|

|

15

21

|

- **Efficient Spread Estimation**: Implements the EDGE estimator for single, rolling, and expanding windows.

|

|

@@ -21,6 +27,61 @@ This library is designed for quantitative finance professionals, researchers, an

|

|

|

21

27

|

- **Comprehensive Tests**: Extensive unit tests with known test cases from the original paper.

|

|

22

28

|

- **Clear Documentation**: Detailed docstrings and usage examples.

|

|

23

29

|

|

|

30

|

+

## Examples and Visualizations

|

|

31

|

+

|

|

32

|

+

The package includes comprehensive examples with beautiful visualizations:

|

|

33

|

+

|

|

34

|

+

### Spread Monitor Results

|

|

35

|

+

|

|

36

|

+

|

|

37

|

+

### Basic Data Analysis

|

|

38

|

+

|

|

39

|

+

|

|

40

|

+

### Crypto Spread Comparison

|

|

41

|

+

|

|

42

|

+

|

|

43

|

+

## FAQ

|

|

44

|

+

|

|

45

|

+

### What exactly does the estimator compute?

|

|

46

|

+

The estimator returns the root mean square effective spread over the sample period. This quantifies the average transaction cost implied by bid-ask spreads, based on open, high, low, and close (OHLC) prices.

|

|

47

|

+

|

|

48

|

+

### What is unique about this implementation?

|

|

49

|

+

This package provides a highly optimized and robust implementation of the EDGE estimator. Beyond a direct translation of the paper's formula, it features:

|

|

50

|

+

|

|

51

|

+

- A Hybrid, High-Performance Engine: The core logic leverages fast, vectorized NumPy operations for data preparation and calls a specialized, JIT-compiled kernel via Numba for the computationally intensive GMM calculations.

|

|

52

|

+

- HFT-Ready Version (edge_hft.py): An included, hyper-optimized function that uses fastmath compilation for the absolute lowest latency, designed for production HFT pipelines where every microsecond matters.

|

|

53

|

+

- Robust Data Handling: Gracefully manages missing values (NaN) and non-positive prices to prevent crashes.

|

|

54

|

+

- Advanced Windowing Functions: Efficient and correct edge_rolling and edge_expanding functions that are fully compatible with the powerful features of pandas, including custom step sizes.

|

|

55

|

+

|

|

56

|

+

### What's the difference between the edge functions?

|

|

57

|

+

The library provides a tiered set of functions for different needs:

|

|

58

|

+

|

|

59

|

+

- edge(): The core function. It's fast, robust, and computes a single spread estimate for a given sample of data. This is the building block for all other functions.

|

|

60

|

+

- edge_hft(): A specialized version of edge() for HFT users. It's the fastest possible implementation but requires perfectly clean input data (no NaNs) to achieve its speed.

|

|

61

|

+

- edge_rolling(): Computes the spread on a rolling window over a time series. It's perfect for seeing how the spread evolves over time. It is highly optimized and accepts all arguments from pandas.DataFrame.rolling() (like window and step).

|

|

62

|

+

- edge_expanding(): Computes the spread on an expanding (cumulative) window. This is useful for analyzing how the spread estimate converges or changes as more data becomes available.

|

|

63

|

+

|

|

64

|

+

### What is the minimum number of observations?

|

|

65

|

+

At least 3 valid observations are required.

|

|

66

|

+

|

|

67

|

+

### How should I choose the window size or frequency?

|

|

68

|

+

Short windows (e.g. a few days) reflect local spread conditions but may be noisy. Longer windows (e.g. 1 year) reduce variance but smooth over changes. For intraday use, minute-level frequency is recommended if the asset trades frequently.

|

|

69

|

+

|

|

70

|

+

Rule of thumb: ensure on average ≥2 trades per interval.

|

|

71

|

+

|

|

72

|

+

### Can I use intraday or tick data?

|

|

73

|

+

Yes — the estimator supports intraday OHLC data directly. For tick data, resample into OHLC format first (e.g., using pandas.resample).

|

|

74

|

+

|

|

75

|

+

### What if I get NaN results?

|

|

76

|

+

The estimator may return NaN if:

|

|

77

|

+

|

|

78

|

+

- Input prices are inconsistent (e.g. high < low)

|

|

79

|

+

- There are too many missing or invalid values

|

|

80

|

+

- Probability thresholds are not met (e.g. insufficient variance in prices)

|

|

81

|

+

- Spread variance is non-positive

|

|

82

|

+

|

|

83

|

+

In these cases, re-examine your input or adjust the sampling frequency.

|

|

84

|

+

|

|

24

85

|

## Installation

|

|

25

86

|

|

|

26

87

|

Install the library via pip:

|

|

@@ -82,9 +143,9 @@ from quantjourney_bidask import edge_rolling

|

|

|

82

143

|

import asyncio

|

|

83

144

|

|

|

84

145

|

# Fetch stock data

|

|

85

|

-

stock_df = get_stock_data("

|

|

146

|

+

stock_df = get_stock_data("PL", period="1mo", interval="1d")

|

|

86

147

|

stock_spreads = edge_rolling(stock_df, window=20)

|

|

87

|

-

print(f"

|

|

148

|

+

print(f"PL average spread: {stock_spreads.mean():.6f}")

|

|

88

149

|

|

|

89

150

|

# Fetch crypto data (async)

|

|

90

151

|

async def get_crypto_spreads():

|

|

@@ -137,10 +198,13 @@ monitor.start_monitoring("1m")

|

|

|

137

198

|

|

|

138

199

|

```python

|

|

139

200

|

# Run the real-time dashboard

|

|

140

|

-

python examples/

|

|

201

|

+

python examples/websocket_realtime_demo.py --mode dashboard

|

|

202

|

+

|

|

203

|

+

# Or console mode

|

|

204

|

+

python examples/websocket_realtime_demo.py --mode console

|

|

141

205

|

|

|

142

|

-

#

|

|

143

|

-

python examples/

|

|

206

|

+

# Quick 30-second BTC websocket demo

|

|

207

|

+

python examples/animated_spread_monitor.py

|

|

144

208

|

```

|

|

145

209

|

|

|

146

210

|

## Project Structure

|

|

@@ -149,42 +213,32 @@ python examples/realtime_spread_monitor.py --mode console

|

|

|

149

213

|

quantjourney_bidask/

|

|

150

214

|

├── quantjourney_bidask/ # Main library code

|

|

151

215

|

│ ├── __init__.py

|

|

152

|

-

│ ├── edge.py # Core EDGE estimator

|

|

216

|

+

│ ├── edge.py # Core EDGE estimator

|

|

217

|

+

│ ├── edge_hft.py # EDGE estimator optimised HFT-version

|

|

153

218

|

│ ├── edge_rolling.py # Rolling window estimation

|

|

154

219

|

│ └── edge_expanding.py # Expanding window estimation

|

|

155

220

|

├── data/

|

|

156

221

|

│ └── fetch.py # Simplified data fetcher for examples

|

|

157

222

|

├── examples/ # Comprehensive usage examples

|

|

158

223

|

│ ├── simple_data_example.py # Basic usage demonstration

|

|

159

|

-

│ ├──

|

|

224

|

+

│ ├── basic_spread_estimation.py # Core spread estimation examples

|

|

160

225

|

│ ├── animated_spread_monitor.py # Animated visualizations

|

|

161

226

|

│ ├── crypto_spread_comparison.py # Crypto spread analysis

|

|

162

227

|

│ ├── liquidity_risk_monitor.py # Risk monitoring

|

|

163

|

-

│ ├──

|

|

164

|

-

│ └──

|

|

228

|

+

│ ├── websocket_realtime_demo.py # Live websocket monitoring demo

|

|

229

|

+

│ └── threshold_alert_monitor.py # Threshold-based spread alerts

|

|

165

230

|

├── tests/ # Unit tests (GitHub only)

|

|

166

231

|

│ ├── test_edge.py

|

|

167

232

|

│ ├── test_edge_rolling.py

|

|

233

|

+

│ └── test_edge_expanding.py

|

|

168

234

|

│ └── test_data_fetcher.py

|

|

235

|

+

│ └── test_estimators.py

|

|

169

236

|

└── _output/ # Example output images

|

|

170

237

|

├── simple_data_example.png

|

|

171

238

|

├── crypto_spread_comparison.png

|

|

172

239

|

└── spread_estimator_results.png

|

|

173

240

|

```

|

|

174

241

|

|

|

175

|

-

## Examples and Visualizations

|

|

176

|

-

|

|

177

|

-

The package includes comprehensive examples with beautiful visualizations:

|

|

178

|

-

|

|

179

|

-

### Basic Data Analysis

|

|

180

|

-

|

|

181

|

-

|

|

182

|

-

### Crypto Spread Comparison

|

|

183

|

-

|

|

184

|

-

|

|

185

|

-

### Spread Estimation Results

|

|

186

|

-

|

|

187

|

-

|

|

188

242

|

### Running Examples

|

|

189

243

|

|

|

190

244

|

After installing via pip, examples are included in the package:

|

|

@@ -209,19 +263,20 @@ Or clone the repository for full access to examples and tests:

|

|

|

209

263

|

git clone https://github.com/QuantJourneyOrg/qj_bidask

|

|

210

264

|

cd qj_bidask

|

|

211

265

|

python examples/simple_data_example.py

|

|

212

|

-

python examples/

|

|

266

|

+

python examples/basic_spread_estimation.py

|

|

267

|

+

python examples/animated_spread_monitor.py # 30s real BTC websocket demo

|

|

213

268

|

python examples/crypto_spread_comparison.py

|

|

214

269

|

```

|

|

215

270

|

|

|

216

271

|

### Available Examples

|

|

217

272

|

|

|

218

273

|

- **`simple_data_example.py`** - Basic usage with stock and crypto data

|

|

219

|

-

- **`

|

|

220

|

-

- **`animated_spread_monitor.py`** - Real-time animated visualizations

|

|

221

|

-

- **`crypto_spread_comparison.py`** - Multi-asset crypto analysis

|

|

274

|

+

- **`basic_spread_estimation.py`** - Core spread estimation functionality

|

|

275

|

+

- **`animated_spread_monitor.py`** - Real-time animated visualizations with 30s websocket demo

|

|

276

|

+

- **`crypto_spread_comparison.py`** - Multi-asset crypto analysis and comparison

|

|

222

277

|

- **`liquidity_risk_monitor.py`** - Risk monitoring and alerts

|

|

223

|

-

- **`

|

|

224

|

-

- **`

|

|

278

|

+

- **`websocket_realtime_demo.py`** - Live websocket monitoring dashboard

|

|

279

|

+

- **`threshold_alert_monitor.py`** - Threshold-based spread alerts and monitoring

|

|

225

280

|

|

|

226

281

|

## Testing and Development

|

|

227

282

|

|

|

@@ -256,7 +311,8 @@ python -m pytest tests/test_data_fetcher.py -v

|

|

|

256

311

|

|

|

257

312

|

# Run examples

|

|

258

313

|

python examples/simple_data_example.py

|

|

259

|

-

python examples/

|

|

314

|

+

python examples/basic_spread_estimation.py

|

|

315

|

+

python examples/animated_spread_monitor.py # Real BTC websocket demo

|

|

260

316

|

```

|

|

261

317

|

|

|

262

318

|

### Package vs Repository

|

|

@@ -329,7 +385,8 @@ pip install -e ".[dev]"

|

|

|

329

385

|

pytest

|

|

330

386

|

|

|

331

387

|

# Run examples

|

|

332

|

-

python examples/

|

|

388

|

+

python examples/animated_spread_monitor.py # 30s real BTC websocket demo

|

|

389

|

+

python examples/websocket_realtime_demo.py # Full dashboard

|

|

333

390

|

```

|

|

334

391

|

|

|

335

392

|

## Support

|