quantjourney-bidask 0.9.0__tar.gz → 0.9.2__tar.gz

This diff represents the content of publicly available package versions that have been released to one of the supported registries. The information contained in this diff is provided for informational purposes only and reflects changes between package versions as they appear in their respective public registries.

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/PKG-INFO +4 -20

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/README.md +3 -19

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/examples/spread_estimator.py +13 -9

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/examples/spread_monitor.py +4 -3

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/pyproject.toml +1 -1

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/quantjourney_bidask/_version.py +1 -1

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/quantjourney_bidask/edge.py +7 -3

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/quantjourney_bidask/edge_expanding.py +9 -3

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/quantjourney_bidask/edge_rolling.py +9 -3

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/CHANGELOG.md +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/LICENSE +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/MANIFEST.in +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/data/fetch.py +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/docs/usage_examples.ipynb +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/examples/animated_spread_monitor.py +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/examples/crypto_spread_comparison.py +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/examples/ff.py +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/examples/liquidity_risk_monitor.py +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/examples/realtime_spread_monitor.py +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/examples/simple_data_example.py +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/examples/stock_liquidity_risk.py +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/examples/visualization.py +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/quantjourney_bidask/__init__.py +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/quantjourney_bidask/data_fetcher.py +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/quantjourney_bidask/websocket_fetcher.py +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/quantjourney_bidask.egg-info/SOURCES.txt +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/requirements.txt +0 -0

- {quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/setup.cfg +0 -0

|

@@ -1,6 +1,6 @@

|

|

|

1

1

|

Metadata-Version: 2.4

|

|

2

2

|

Name: quantjourney-bidask

|

|

3

|

-

Version: 0.9.

|

|

3

|

+

Version: 0.9.2

|

|

4

4

|

Summary: Efficient bid-ask spread estimator from OHLC prices

|

|

5

5

|

Author-email: Jakub Polec <jakub@quantjourney.pro>

|

|

6

6

|

License-Expression: MIT

|

|

@@ -218,13 +218,13 @@ quantjourney_bidask/

|

|

|

218

218

|

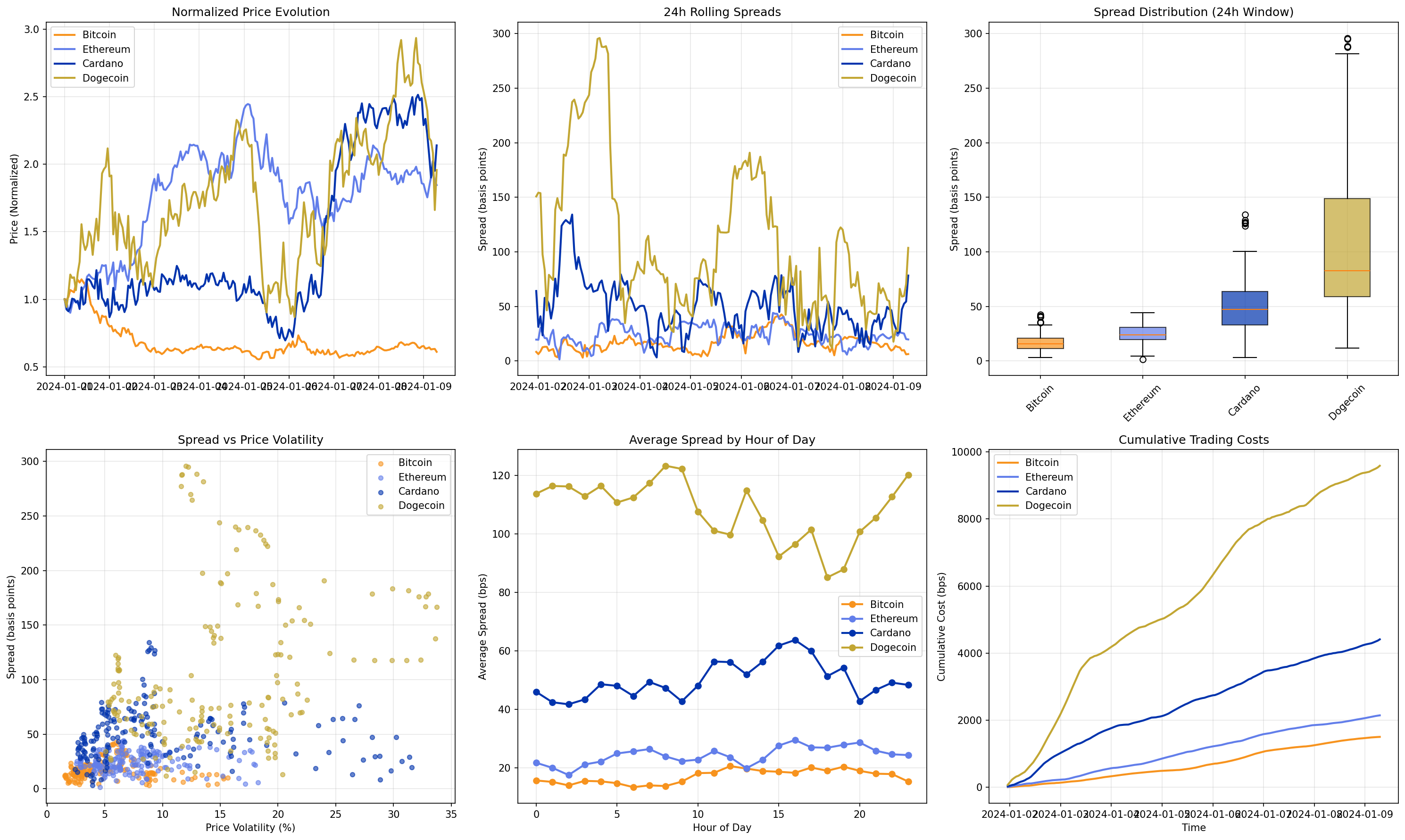

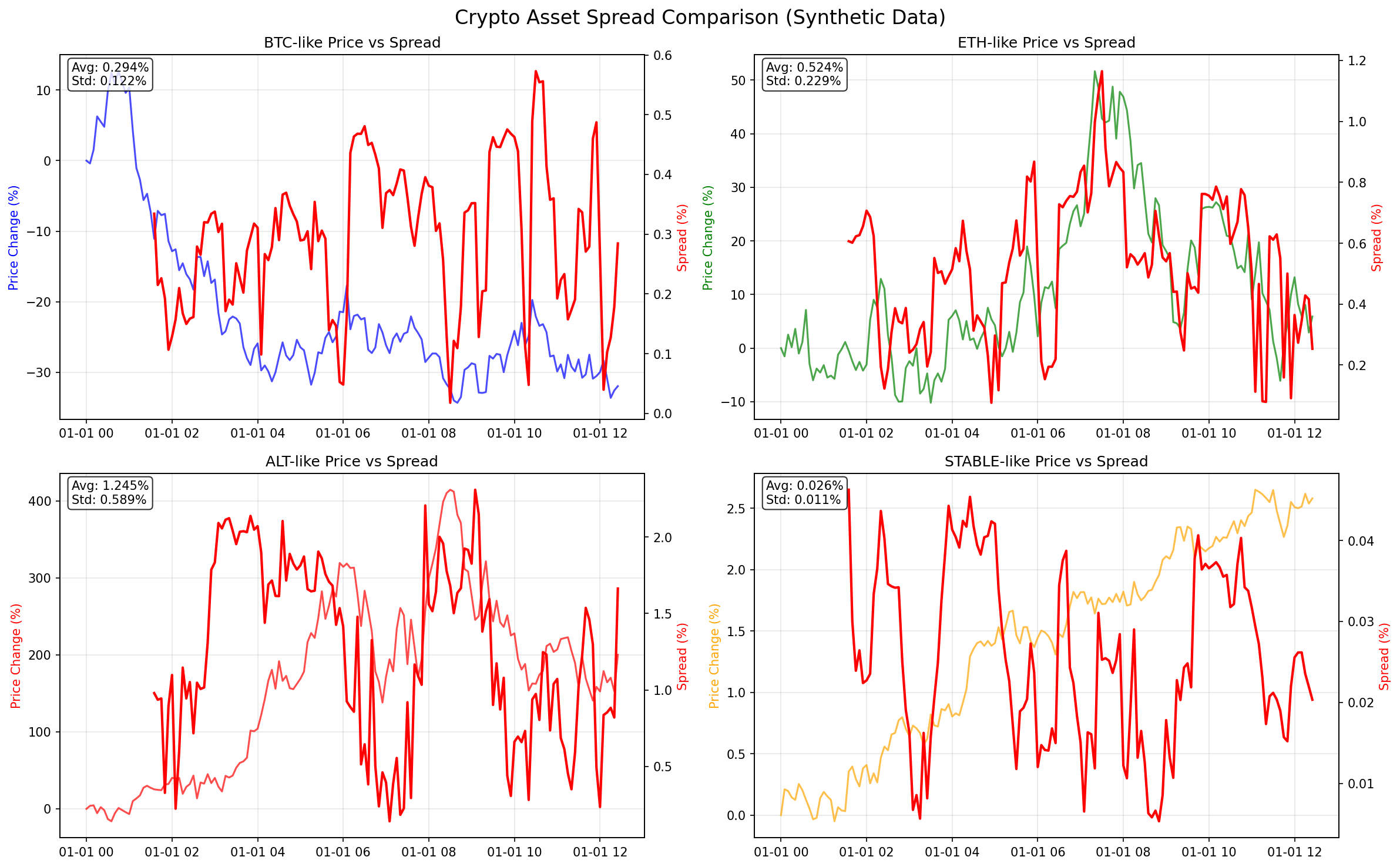

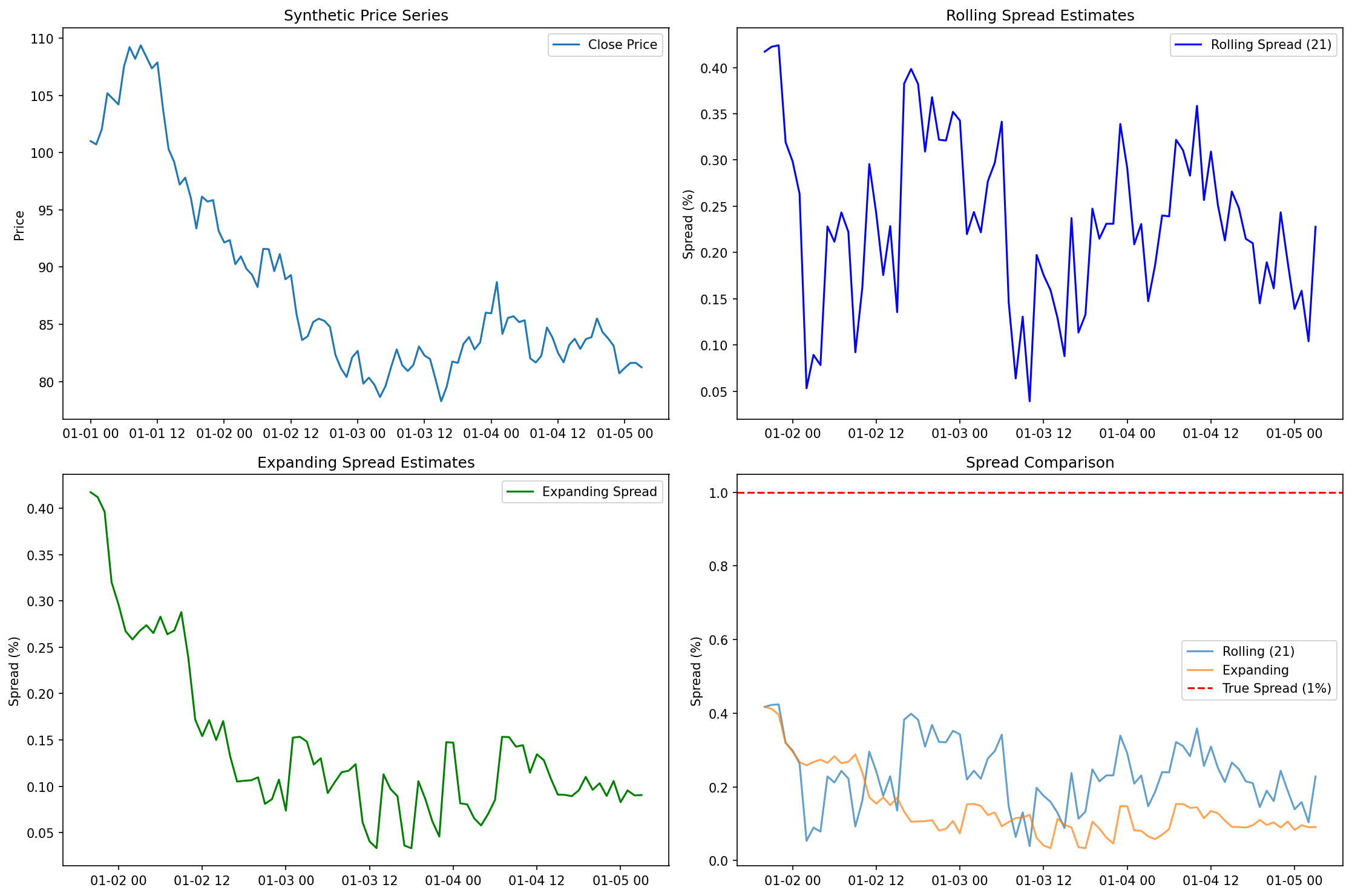

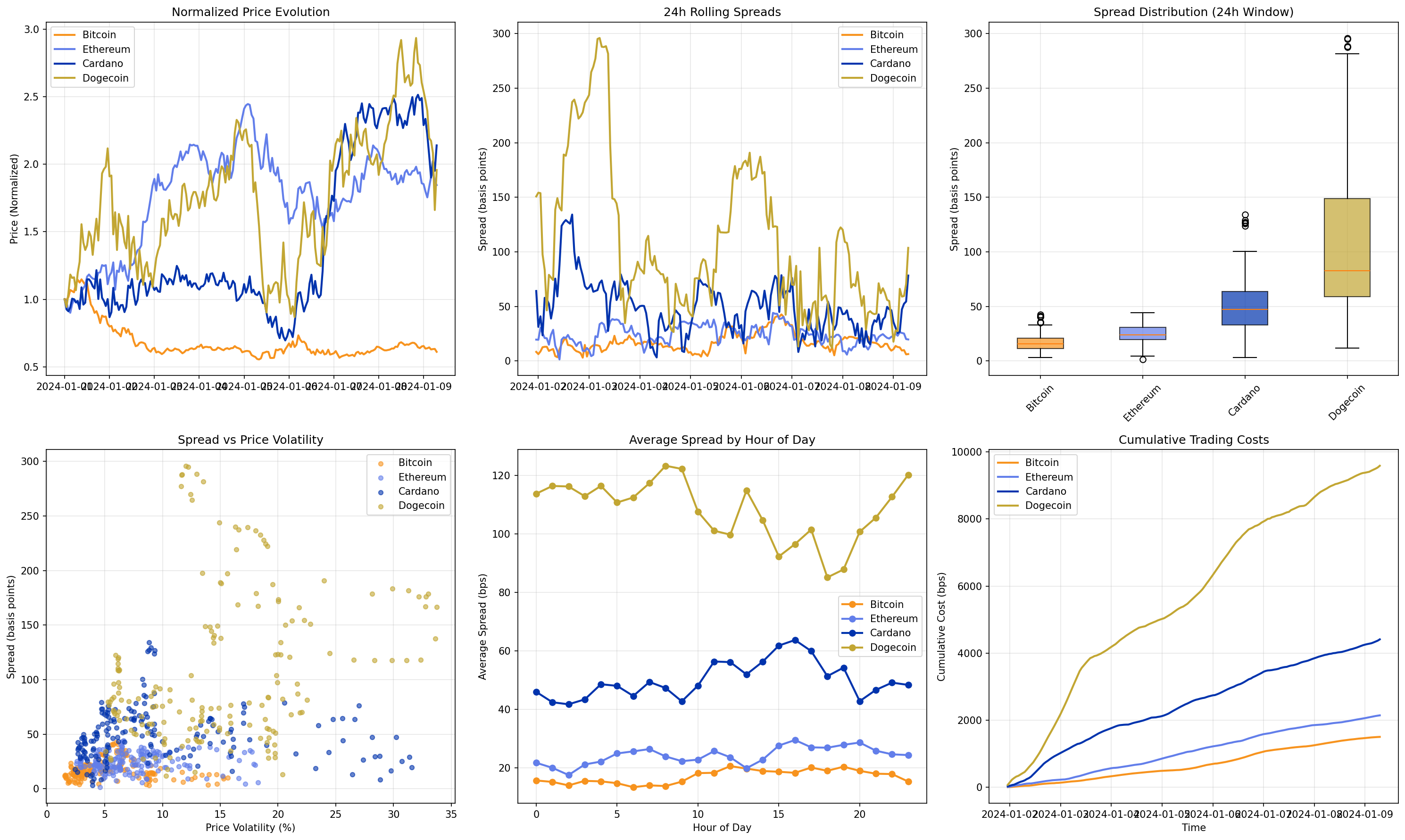

The package includes comprehensive examples with beautiful visualizations:

|

|

219

219

|

|

|

220

220

|

### Basic Data Analysis

|

|

221

|

-

|

|

221

|

+

|

|

222

222

|

|

|

223

223

|

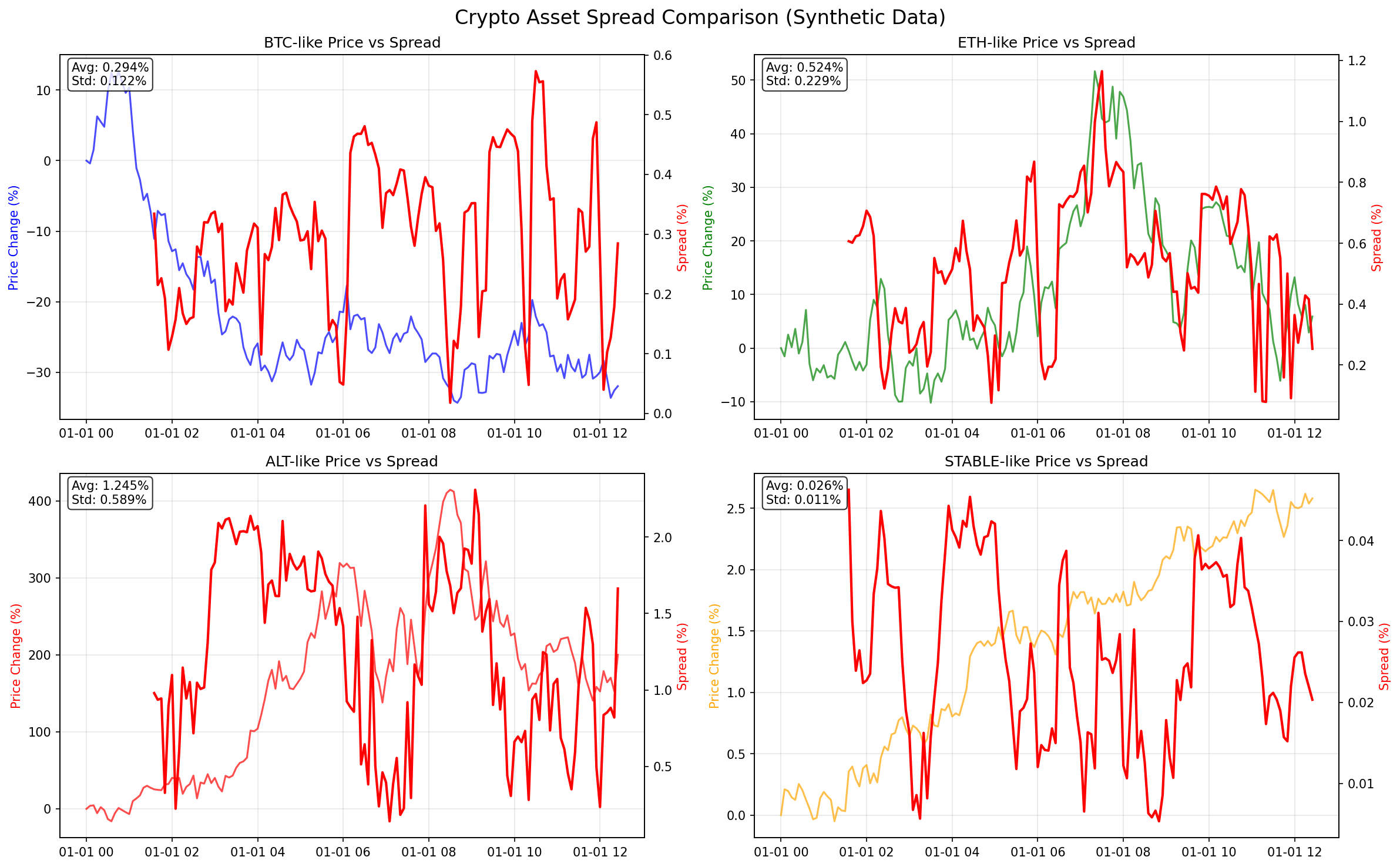

### Crypto Spread Comparison

|

|

224

|

-

|

|

224

|

+

|

|

225

225

|

|

|

226

226

|

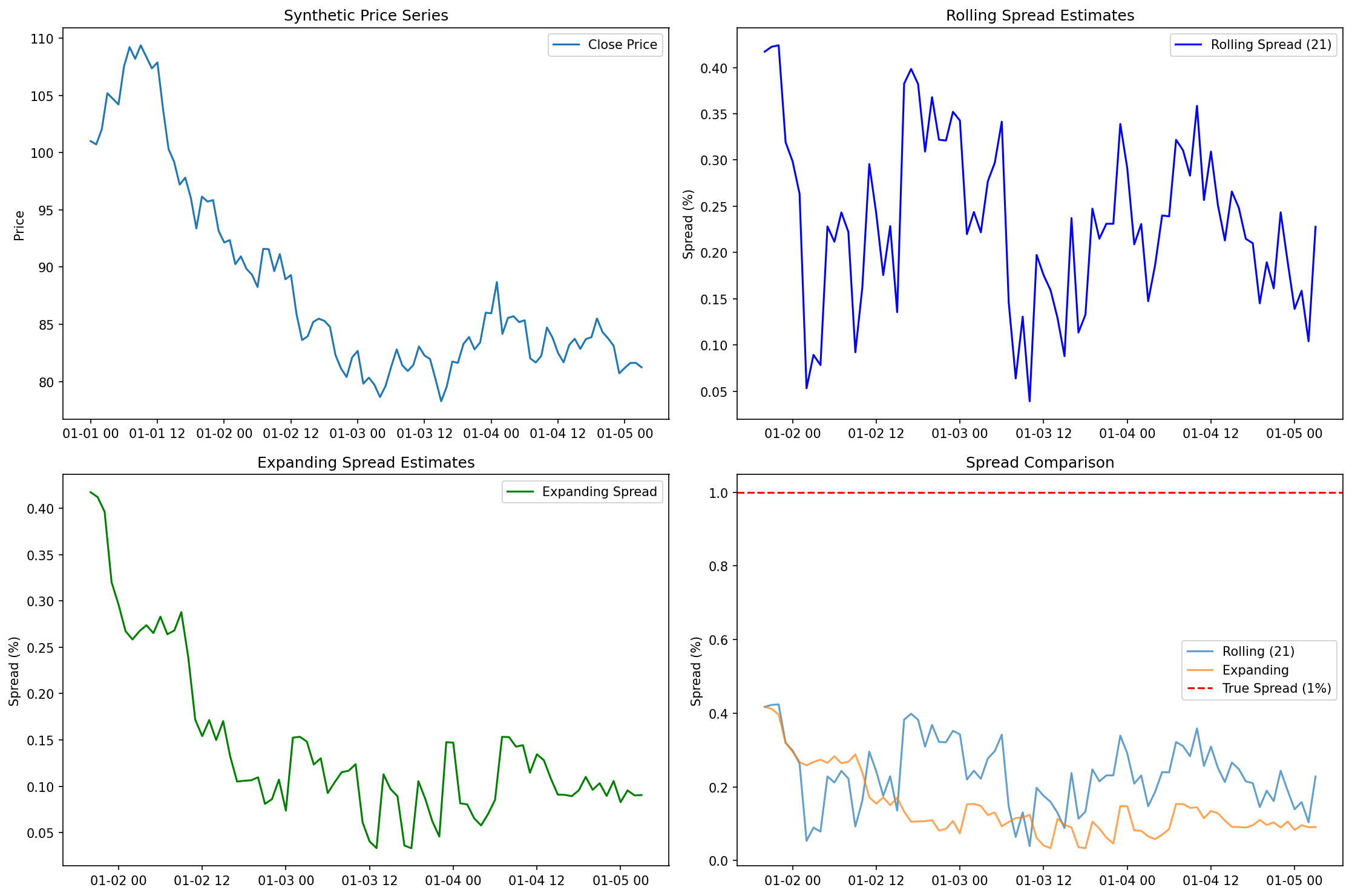

### Spread Estimation Results

|

|

227

|

-

|

|

227

|

+

|

|

228

228

|

|

|

229

229

|

### Running Examples

|

|

230

230

|

|

|

@@ -351,22 +351,6 @@ Real-time features:

|

|

|

351

351

|

- Threshold alerts

|

|

352

352

|

- Multi-symbol monitoring

|

|

353

353

|

|

|

354

|

-

## Academic Citation

|

|

355

|

-

|

|

356

|

-

If you use this library in academic research, please cite:

|

|

357

|

-

|

|

358

|

-

```bibtex

|

|

359

|

-

@article{ardia2024efficient,

|

|

360

|

-

title={Efficient Estimation of Bid-Ask Spreads from Open, High, Low, and Close Prices},

|

|

361

|

-

author={Ardia, David and Guidotti, Emanuele and Kroencke, Tim A},

|

|

362

|

-

journal={Journal of Financial Economics},

|

|

363

|

-

volume={161},

|

|

364

|

-

pages={103916},

|

|

365

|

-

year={2024},

|

|

366

|

-

publisher={Elsevier}

|

|

367

|

-

}

|

|

368

|

-

```

|

|

369

|

-

|

|

370

354

|

## License

|

|

371

355

|

|

|

372

356

|

This project is licensed under the MIT License - see the [LICENSE](LICENSE) file for details.

|

|

@@ -177,13 +177,13 @@ quantjourney_bidask/

|

|

|

177

177

|

The package includes comprehensive examples with beautiful visualizations:

|

|

178

178

|

|

|

179

179

|

### Basic Data Analysis

|

|

180

|

-

|

|

180

|

+

|

|

181

181

|

|

|

182

182

|

### Crypto Spread Comparison

|

|

183

|

-

|

|

183

|

+

|

|

184

184

|

|

|

185

185

|

### Spread Estimation Results

|

|

186

|

-

|

|

186

|

+

|

|

187

187

|

|

|

188

188

|

### Running Examples

|

|

189

189

|

|

|

@@ -310,22 +310,6 @@ Real-time features:

|

|

|

310

310

|

- Threshold alerts

|

|

311

311

|

- Multi-symbol monitoring

|

|

312

312

|

|

|

313

|

-

## Academic Citation

|

|

314

|

-

|

|

315

|

-

If you use this library in academic research, please cite:

|

|

316

|

-

|

|

317

|

-

```bibtex

|

|

318

|

-

@article{ardia2024efficient,

|

|

319

|

-

title={Efficient Estimation of Bid-Ask Spreads from Open, High, Low, and Close Prices},

|

|

320

|

-

author={Ardia, David and Guidotti, Emanuele and Kroencke, Tim A},

|

|

321

|

-

journal={Journal of Financial Economics},

|

|

322

|

-

volume={161},

|

|

323

|

-

pages={103916},

|

|

324

|

-

year={2024},

|

|

325

|

-

publisher={Elsevier}

|

|

326

|

-

}

|

|

327

|

-

```

|

|

328

|

-

|

|

329

313

|

## License

|

|

330

314

|

|

|

331

315

|

This project is licensed under the MIT License - see the [LICENSE](LICENSE) file for details.

|

|

@@ -22,13 +22,17 @@ print("Spread Estimator Examples")

|

|

|

22

22

|

print("========================")

|

|

23

23

|

|

|

24

24

|

# Test data download from the original paper

|

|

25

|

-

print("\n1. Testing with

|

|

26

|

-

|

|

27

|

-

|

|

28

|

-

|

|

29

|

-

|

|

30

|

-

|

|

31

|

-

|

|

25

|

+

print("\n1. Testing with sample OHLC data...")

|

|

26

|

+

# Create sample OHLC data for testing

|

|

27

|

+

sample_data = {

|

|

28

|

+

'Open': [100.0, 101.5, 99.8, 102.1, 100.9, 103.2, 101.7, 104.5, 102.3, 105.1],

|

|

29

|

+

'High': [102.3, 103.0, 101.2, 103.5, 102.0, 104.8, 103.1, 106.2, 104.0, 106.5],

|

|

30

|

+

'Low': [99.5, 100.8, 98.9, 101.0, 100.1, 102.5, 101.0, 103.8, 101.5, 104.2],

|

|

31

|

+

'Close': [101.2, 102.5, 100.3, 102.8, 101.5, 104.1, 102.4, 105.7, 103.2, 105.8]

|

|

32

|

+

}

|

|

33

|

+

df = pd.DataFrame(sample_data)

|

|

34

|

+

spread = edge(df.Open, df.High, df.Low, df.Close)

|

|

35

|

+

print(f"Sample data spread: {spread:.6f}")

|

|

32

36

|

|

|

33

37

|

# Generate synthetic data for testing

|

|

34

38

|

print("\n2. Testing with synthetic data...")

|

|

@@ -106,8 +110,8 @@ print(f"True embedded spread: {spread_pct*100:.4f}%")

|

|

|

106

110

|

print("\n5. Real data examples (Yahoo Finance)...")

|

|

107

111

|

try:

|

|

108

112

|

# Fetch SPY data

|

|

109

|

-

spy_df =

|

|

110

|

-

|

|

113

|

+

spy_df = get_stock_data(

|

|

114

|

+

ticker="SPY",

|

|

111

115

|

period="1mo",

|

|

112

116

|

interval="1d"

|

|

113

117

|

)

|

|

@@ -9,7 +9,8 @@ import pandas as pd

|

|

|

9

9

|

import matplotlib.pyplot as plt

|

|

10

10

|

import numpy as np

|

|

11

11

|

|

|

12

|

-

from quantjourney_bidask import edge_rolling

|

|

12

|

+

from quantjourney_bidask import edge_rolling

|

|

13

|

+

from data.fetch import get_stock_data

|

|

13

14

|

|

|

14

15

|

|

|

15

16

|

|

|

@@ -165,8 +166,8 @@ if len(high_spread_periods) > 0:

|

|

|

165

166

|

print("\n5. Real data example...")

|

|

166

167

|

try:

|

|

167

168

|

# Fetch real data

|

|

168

|

-

real_df =

|

|

169

|

-

|

|

169

|

+

real_df = get_stock_data(

|

|

170

|

+

ticker="QQQ", # NASDAQ ETF

|

|

170

171

|

period="2mo",

|

|

171

172

|

interval="1h"

|

|

172

173

|

)

|

|

@@ -47,10 +47,14 @@ def edge(

|

|

|

47

47

|

Examples

|

|

48

48

|

--------

|

|

49

49

|

>>> import pandas as pd

|

|

50

|

-

>>>

|

|

51

|

-

>>>

|

|

50

|

+

>>> # Example OHLC data

|

|

51

|

+

>>> open_prices = [100.0, 101.5, 99.8, 102.1, 100.9]

|

|

52

|

+

>>> high_prices = [102.3, 103.0, 101.2, 103.5, 102.0]

|

|

53

|

+

>>> low_prices = [99.5, 100.8, 98.9, 101.0, 100.1]

|

|

54

|

+

>>> close_prices = [101.2, 102.5, 100.3, 102.8, 101.5]

|

|

55

|

+

>>> spread = edge(open_prices, high_prices, low_prices, close_prices)

|

|

52

56

|

>>> print(f"Estimated spread: {spread:.6f}")

|

|

53

|

-

Estimated spread: 0.

|

|

57

|

+

Estimated spread: 0.007109

|

|

54

58

|

"""

|

|

55

59

|

# Convert inputs to numpy arrays

|

|

56

60

|

open = np.asarray(open, dtype=float)

|

{quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/quantjourney_bidask/edge_expanding.py

RENAMED

|

@@ -41,9 +41,15 @@ def edge_expanding(

|

|

|

41

41

|

Examples

|

|

42

42

|

--------

|

|

43

43

|

>>> import pandas as pd

|

|

44

|

-

>>>

|

|

45

|

-

>>>

|

|

46

|

-

|

|

44

|

+

>>> # Example OHLC DataFrame

|

|

45

|

+

>>> df = pd.DataFrame({

|

|

46

|

+

... 'open': [100.0, 101.5, 99.8, 102.1, 100.9, 103.2],

|

|

47

|

+

... 'high': [102.3, 103.0, 101.2, 103.5, 102.0, 104.8],

|

|

48

|

+

... 'low': [99.5, 100.8, 98.9, 101.0, 100.1, 102.5],

|

|

49

|

+

... 'close': [101.2, 102.5, 100.3, 102.8, 101.5, 104.1]

|

|

50

|

+

... })

|

|

51

|

+

>>> spreads = edge_expanding(df, min_periods=3)

|

|

52

|

+

>>> print(spreads.dropna())

|

|

47

53

|

"""

|

|

48

54

|

# Standardize column names

|

|

49

55

|

df = df.rename(columns=str.lower).copy()

|

|

@@ -47,9 +47,15 @@ def edge_rolling(

|

|

|

47

47

|

Examples

|

|

48

48

|

--------

|

|

49

49

|

>>> import pandas as pd

|

|

50

|

-

>>>

|

|

51

|

-

>>>

|

|

52

|

-

|

|

50

|

+

>>> # Example OHLC DataFrame

|

|

51

|

+

>>> df = pd.DataFrame({

|

|

52

|

+

... 'open': [100.0, 101.5, 99.8, 102.1, 100.9],

|

|

53

|

+

... 'high': [102.3, 103.0, 101.2, 103.5, 102.0],

|

|

54

|

+

... 'low': [99.5, 100.8, 98.9, 101.0, 100.1],

|

|

55

|

+

... 'close': [101.2, 102.5, 100.3, 102.8, 101.5]

|

|

56

|

+

... })

|

|

57

|

+

>>> spreads = edge_rolling(df, window=3)

|

|

58

|

+

>>> print(spreads.dropna())

|

|

53

59

|

"""

|

|

54

60

|

# Standardize column names

|

|

55

61

|

df = df.rename(columns=str.lower).copy()

|

|

File without changes

|

|

File without changes

|

|

File without changes

|

|

File without changes

|

|

File without changes

|

|

File without changes

|

{quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/examples/crypto_spread_comparison.py

RENAMED

|

File without changes

|

|

File without changes

|

|

File without changes

|

|

File without changes

|

|

File without changes

|

|

File without changes

|

|

File without changes

|

|

File without changes

|

|

File without changes

|

{quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/quantjourney_bidask/websocket_fetcher.py

RENAMED

|

File without changes

|

{quantjourney_bidask-0.9.0 → quantjourney_bidask-0.9.2}/quantjourney_bidask.egg-info/SOURCES.txt

RENAMED

|

File without changes

|

|

File without changes

|

|

File without changes

|